What is Withholding Tax? Federal Tax ExcelDataPro

Here's what you need to know for the 2023 withholding tax tables: Increase in each income bracket. No withholding allowances for W-4s from 2020 or later. Computational bridge available for W-4s from before 2019. Backup withholding rate remains 24%. No change in the 22% supplemental tax rate.

Revised Withholding Tax Table Bureau of Internal Revenue

Withholding tax is an amount withheld by the party making payment (payer) on income earned by a non-resident (payee) and paid to the Inland Revenue Board of Malaysia. 'Payer' refers to an individual/body other than individual carrying on a business in Malaysia. He is required to withhold tax on payments for services rendered/technical advice.

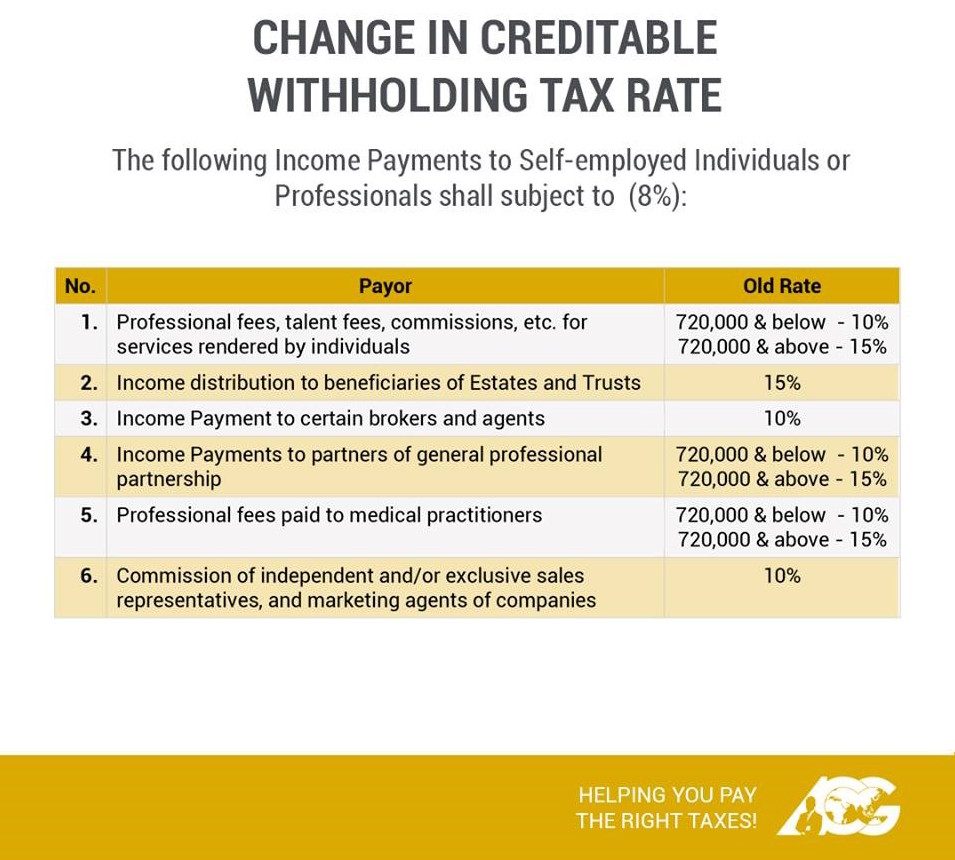

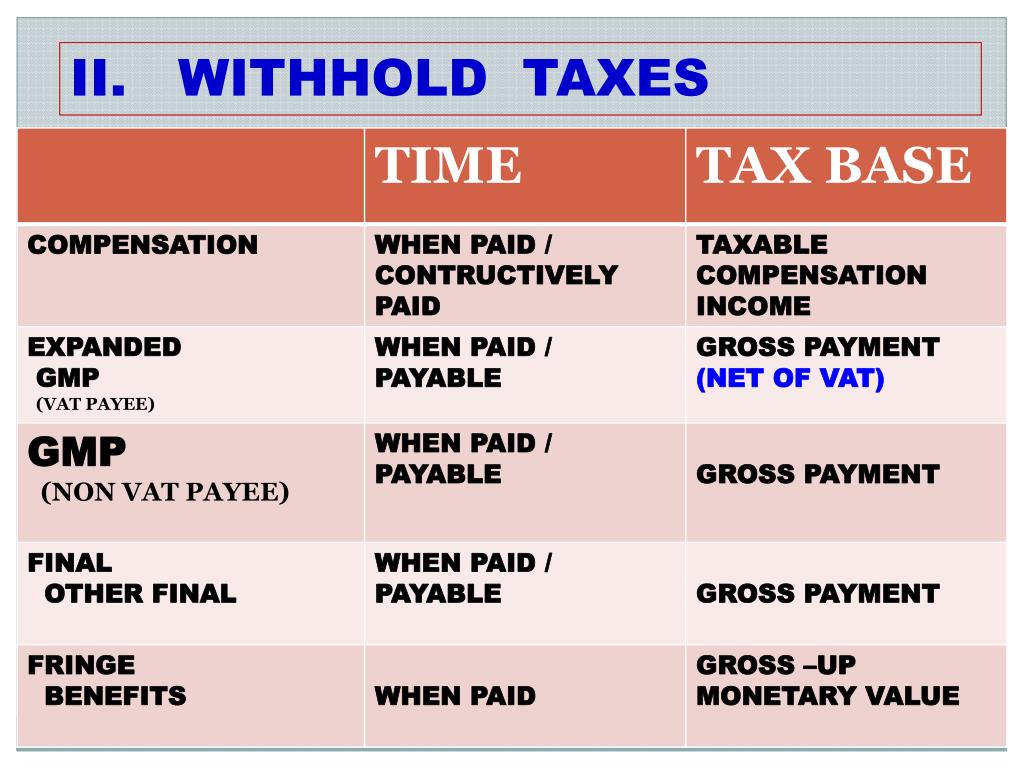

AskTheTaxWhiz Withholding tax

Pengertian Withholding Tax. Sistem withholding tax adalah sistem pemungutan pajak yang dilakukan oleh pemerintah kepada pihak wajib pajak, untuk melaksanakan kewajiban atas penghasilan yang telah dibayarkan kepada pihak penerima penghasilan sekaligus menyetorkannya ke kas negara Indonesia. Jika dijelaskan secara lebih singkat, maka istilah.

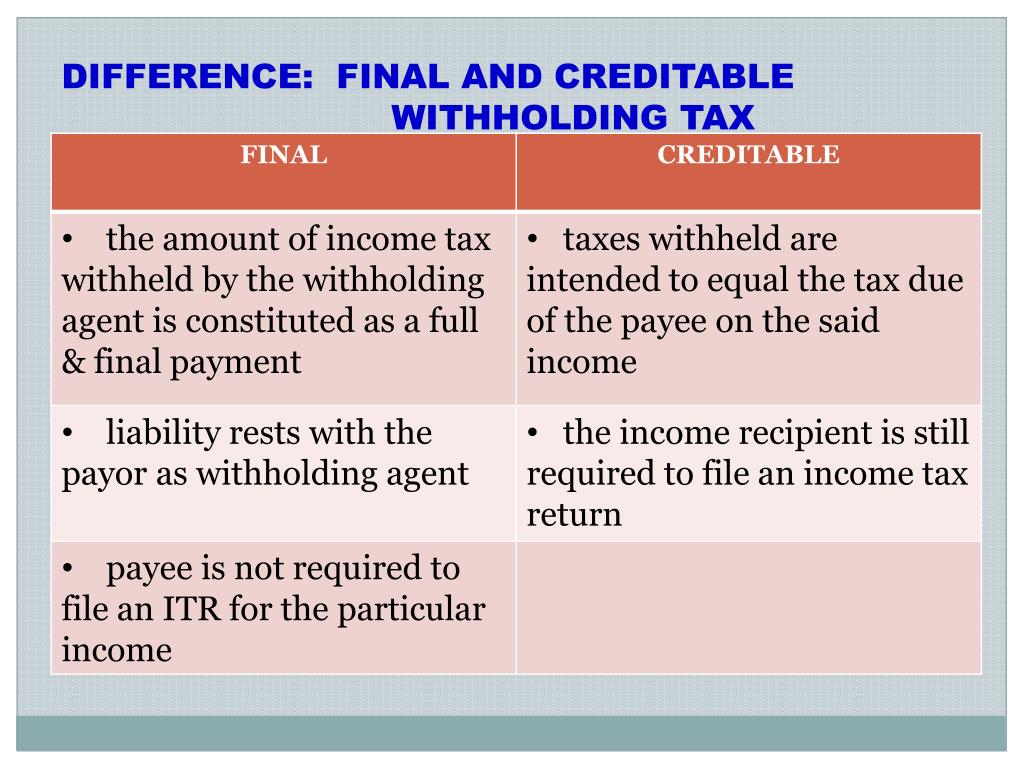

Creditable versus Final Withholding Tax YouTube

Sedangkan withholding tax merupakan pemotongan dan pemungutan pajak melalui pihak ketiga. Artinya, sistem ini lebih mencakup dan ditujukan untuk semua penghasilan yang dihasilkan oleh para pelaku kegiatan usaha. Ini tercantum dalam Peraturan Direktur Jenderal Pajak Nomor PER-70/PJ/2007.

What is a Withholding Tax in Singapore Nexia Singapore PAC

Withholding Tax atau yang sering disingkat dengan WHT adalah salah salah satu sistem pemungutan pajak yang diterapkan di Indonesia.. Artinya, tidak dapat digunakan sebagai pengurang atau kredit pajak di akhir tahun. Penerapan Withholding Tax di Indonesia. Penerapan Withholding Tax . Di Indonesia, penerapan withholding tax dilakukan dengan.

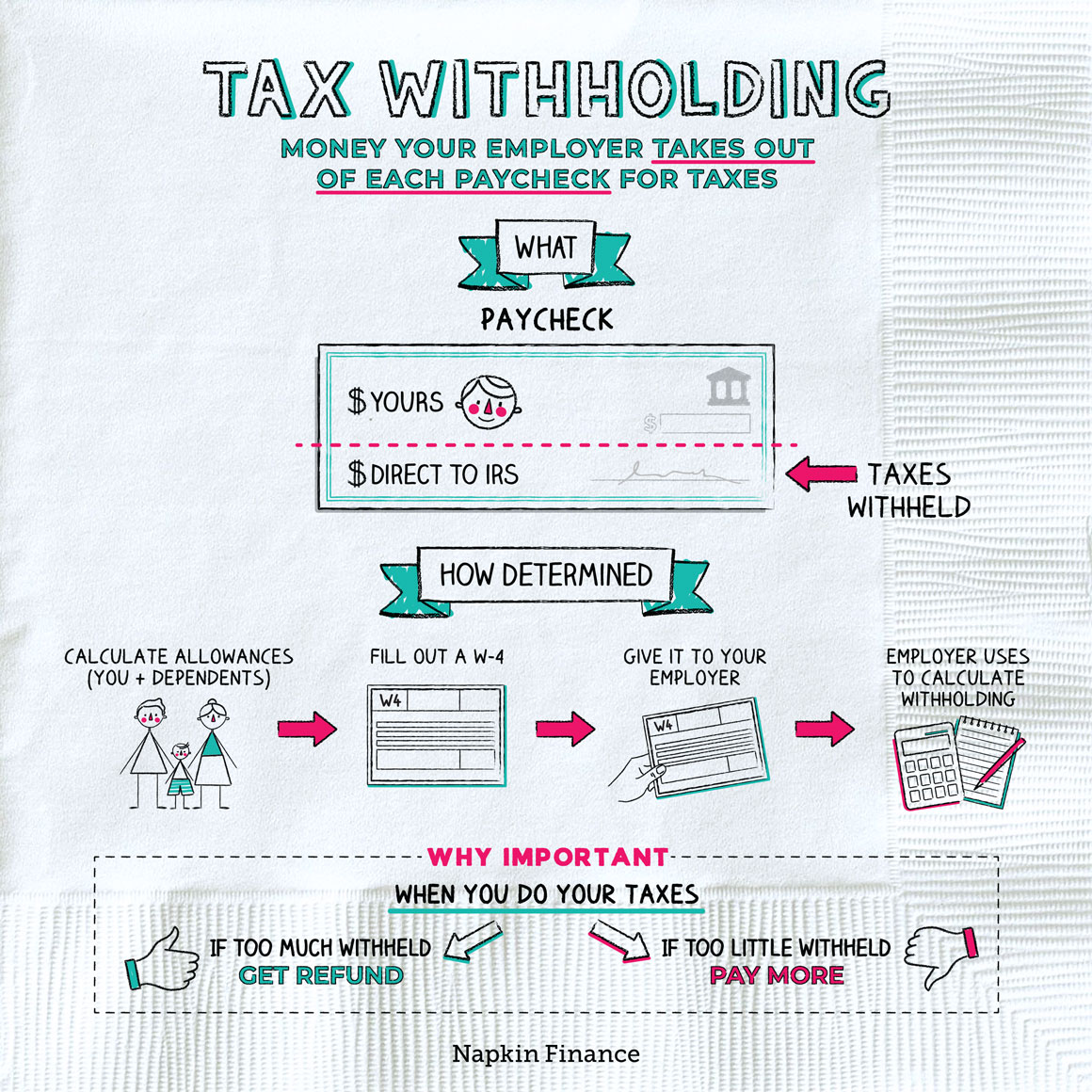

What is Tax Withholding? All Your Questions Answered by Napkin Finance

IRS Percentage Method. To check your Federal Withholding Tax calculation for all earnings on the payslip, use the IRS Percentage Method below: Find Federal Withholding - Taxable Wages in the Taxable Wages section of the payslip. Annualize this amount based on the pay period frequency: If Monthly, multiply by 12; if Semi-Monthly, multiply by 24.

/GettyImages-942154464-05ea84f12d7e495ca4768ec673d6a7e5.jpg)

Withholding Tax คือ อะไร E Payment คืออะไร E Payment คือ อะไร EggThailan

Whether your tax withholding is tabulated by you or an employer through a W-4 form, anything that changes the size of your tax liability, or the amount of taxes you owe, could change the amount of.

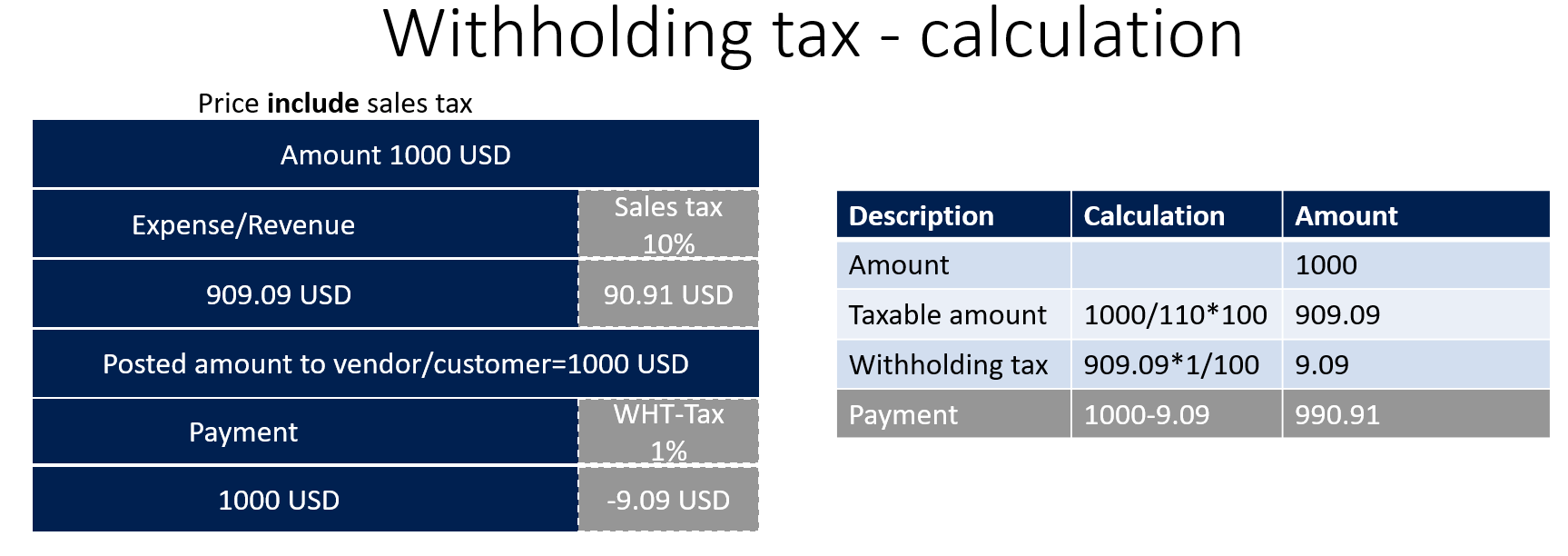

Understanding withholding tax Microsoft Dynamics 365 Enterprise Edition Financial Management

Article 23/26 Income Tax (PPh 23/26) Domestic Article 23 WHT is payable at the rate of 2% for most types of services where the recipient of the payment is an Indonesian resident and 15% for a variety of payments to resident corporations and individuals. For non-residents, Art. 26 WHT of 20% is applicable.

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID3912928

It is a tax of 1.45% on your earnings, and employers typically have to withhold an extra 0.9% on money you earn over $200,000. FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds.

Revised withholding tax table for compensation Tax table, Tax, Compensation

Withholding tax is a portion of federal income tax that an employer withholds from an employee's paycheck. Because federal income tax is a pay-as-you-go tax, employers deduct it from employees' wages throughout the year and send it to the Internal Revenue Service (IRS) on the employee's behalf. The primary purpose of withholding taxes is.

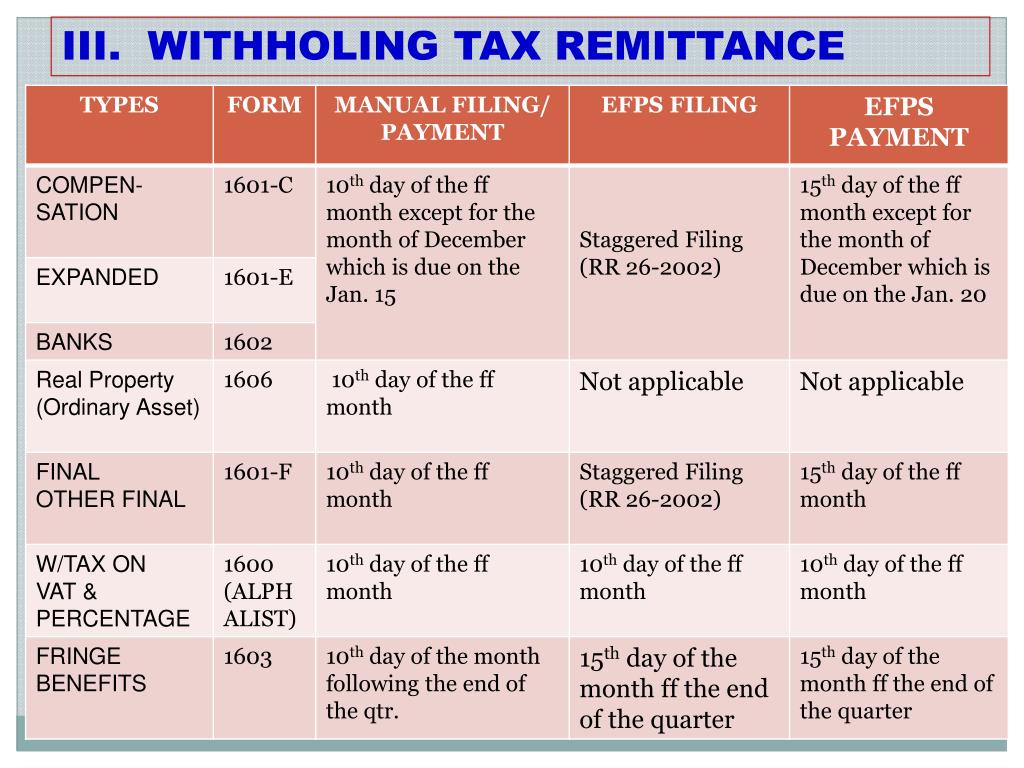

Withholding Taxes in the Philippines All You Need To Know eezi

The Maryland State income tax formula contains a computation for Maryland County tax. Refer to the withholding formula for information on the individual county rates. In the event an employee does not file a State withholding exemption certificate, then Single and zero (00) exemptions will be used as the basis for withholding.

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID3912928

If the business is not registered for Michigan taxes but is required to do so, contact the Michigan Department of Treasury's Business Tax Registration unit at 517-636-6925. Learn More About Registering a Business in Michigan

WHAT YOU NEED TO KNOW ABOUT WITHOLDING TAX INCE Consulting Ltd.

0.30%. Purchasing of gas fuel. 0.30%. Purchasing of lubricants. 0.30%. Manufacturers of cement, steel, automotive goods, paper and cigarettes. 0.1% to 0.45% when selling to agents or distributors. Goods that are classified as very luxurious are subjected to a withholding tax rate of 5% based on the selling prices.

Understanding Withholding Tax YouTube

Tax Withholding. For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W-4. For help with your withholding, you may use the Tax Withholding.

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Withholding Tax Explained Types and How It's Calculated

The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. We don't save or record the information you enter in the estimator. For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. Check your W-4 tax withholding with the IRS Tax.

Withholding Meaning

The payroll tax rate is changing from 0.9097 percent to 0.6997 percent on wages up to the OASDI wage maximum of $168,600. Divide the annual Kentucky County income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain the biweekly Kentucky County income tax withholding. Resources