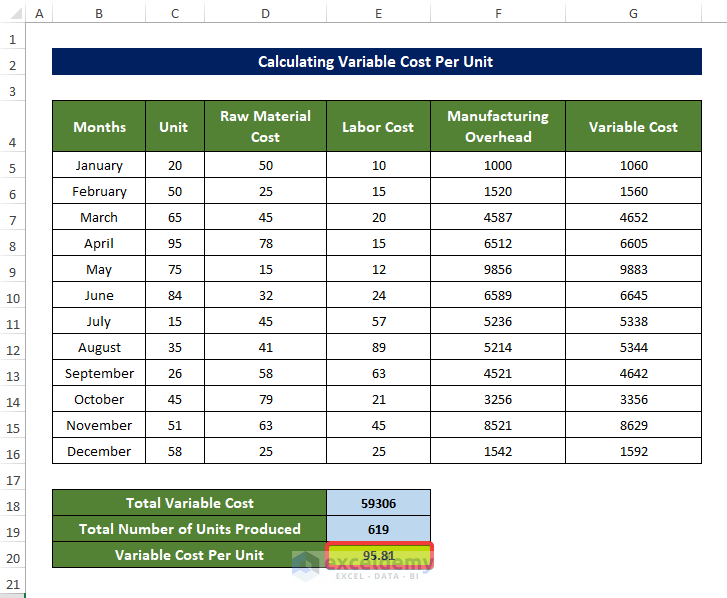

How to Calculate Variable Cost Per Unit in Excel (with Quick Steps)

Break even point (Unit) = Biaya Tetap ÷ (Pendapatan per Unit - Biaya Variabel per Unit) Saat menentukan titik impas berdasarkan nilai penjualan. Bagi biaya tetap dengan margin kontribusi. Margin kontribusi ditentukan dengan mengurangkan biaya variabel dari harga produk. Jumlah ini kemudian digunakan untuk menutupi biaya tetap.

+Biaya+Tetap+(FC)+Jml+biaya.jpg)

Biaya Variabel Per Unit Mempunyai Sifat Akuntansi Manajemen Ppt Download / Biaya depresiasi

Variable Cost: A variable cost is a corporate expense that changes in proportion with production output. Variable costs increase or decrease depending on a company's production volume; they rise.

Variable Cost Definition, Formula and Calculation Wise

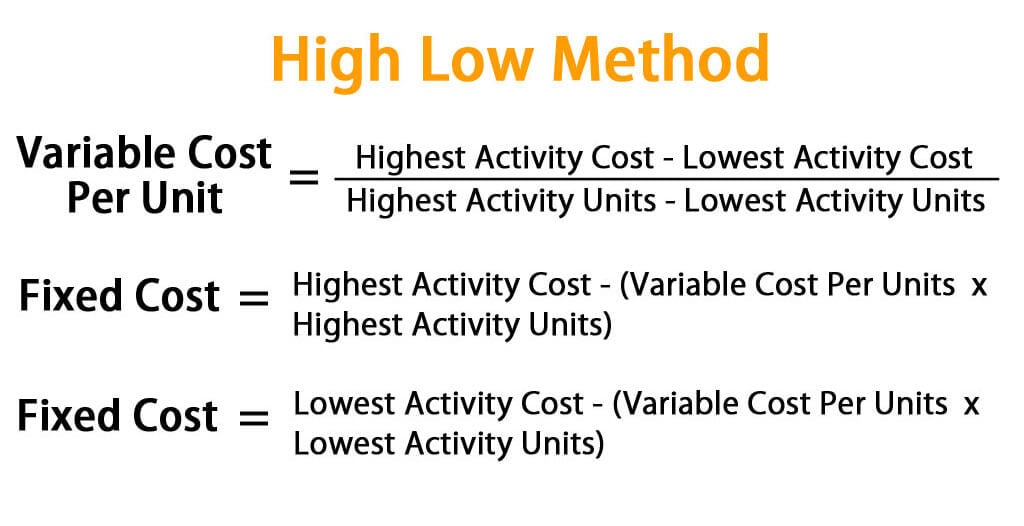

Variable cost per unit is an important component of financial planning. It plays a key role in budgeting, forecasting, and assessing business performance. For example, by projecting your variable cost per unit, you can forecast your total costs based on estimated production volumes.

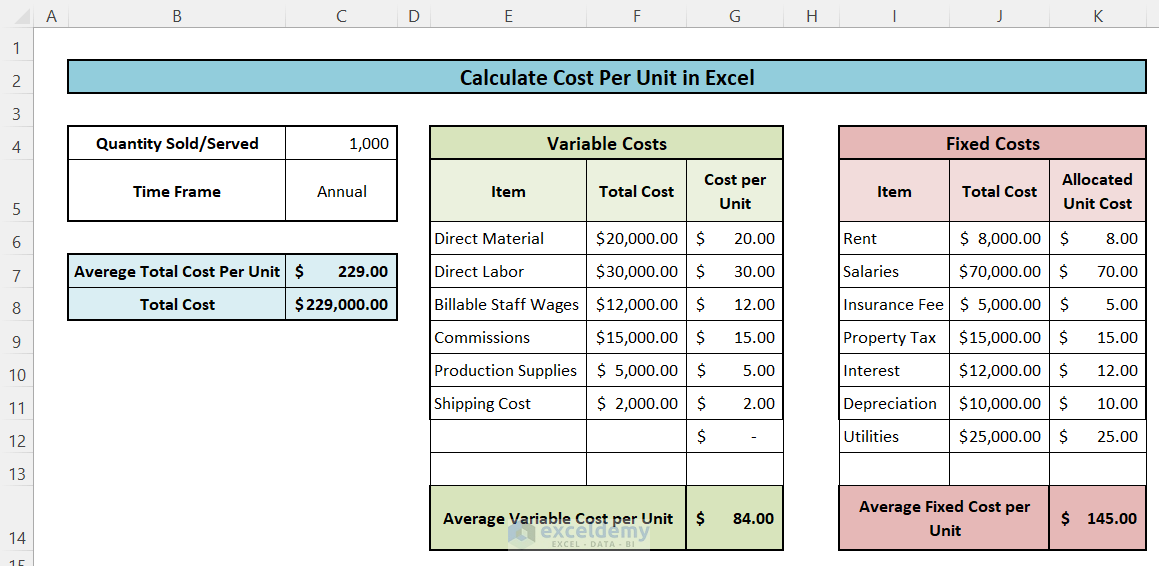

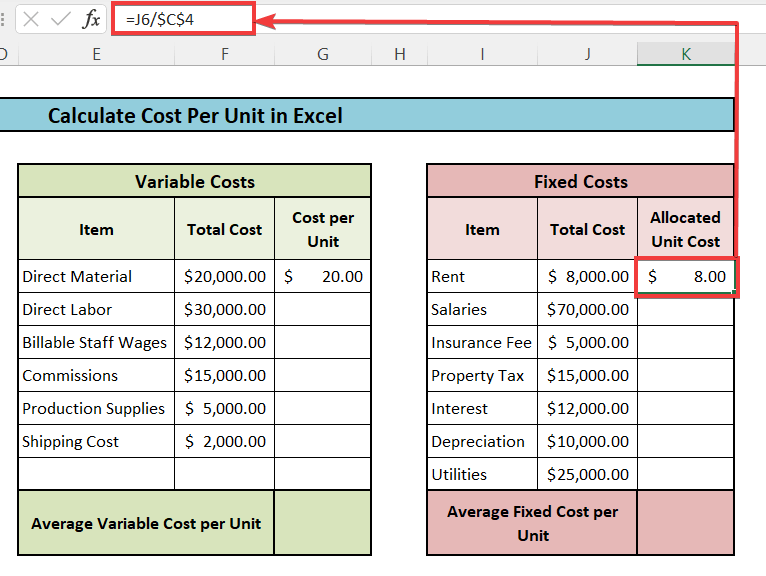

How to Calculate Cost per Unit in Excel (With Easy Steps) ExcelDemy

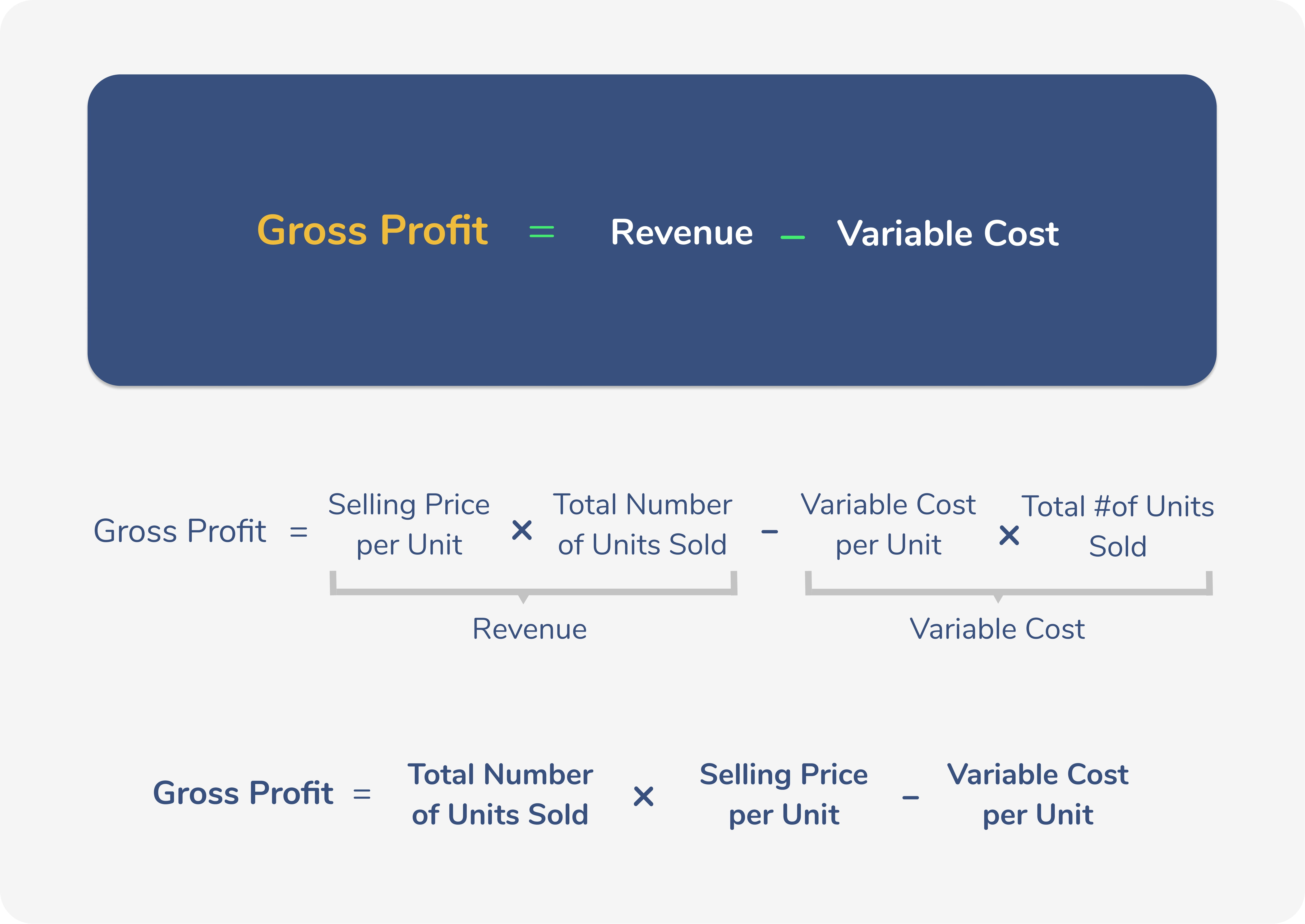

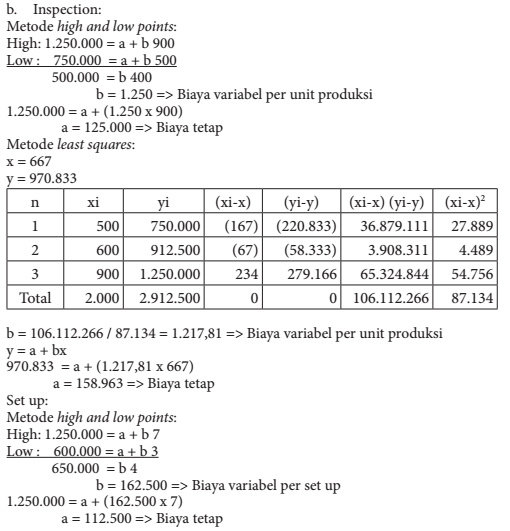

Variable cost per unit = raw materials cost / total output + direct labor cost / total output = $12,000 / 142,300 + $65,200 / 142,300 = $0.08 + $0.46 = $0.54. Therefore, if the company undertakes the order of 3,000 packaging items, it will realize a gross profit of: Gross profit = sales price - total variable cost = $125,000 - $77,200.

PPT Cost Terms, Concepts, and Classifications PowerPoint Presentation ID402735

Calculate the variable cost per unit for September. Solution. Calculation of Total Variable Expenses using the below formula is as follows, Total Variable Expenses = Direct Material Cost + Direct Labor Cost + Packing Expenses + Other Direct Manufacturing Overhead. = $ 1,000,000+ $ 500,000 + $ 20,000 + $ 100,000.

Variable Cost Per Unit Formula Managerial Accounting Idaman

For example, if the fixed costs per unit is $0.10 and the variable cost per unit is $0.40 (for a $0.50 total cost per unit), then 80 percent of the unit cost is variable cost ($ / $ =). As an outside investor, you can use this information to predict potential profit risk.. Bahasa Indonesia: Menghitung Biaya Variabel. Français:.

Biaya Variabel Per Unit Rumus Media Pembelajaran 1 Infocus 2 Kertas Kerja Untuk bisnis

Break-even Point in Units = Fixed Costs / (Sales Price per Unit - Variable Cost per Unit) Consider the following example: Amy wants you to determine the minimum units of goods that she needs to sell in order to reach break-even each month. The bakery only sells one item: cakes. The fixed costs of running the bakery are $1,700 a month and the.

Rumus Biaya per Unit, Cara Hitung di Excel dan Tips Mengoptimalkannya

Q = Total Biaya Tetap ⁄ (Harga Jual Per Unit Produk − Biaya Variabel Per Unit Produk) Rumus BEP Nominal (Rupiah): P = Total Biaya Tetap ⁄ (1 − Biaya Variabel Per Unit Produk ⁄ Harga Jual Per Unit Produk) Nah dalam panduan kali ini, Saya tidak hanya membahas kedua rumus BEP ini saja. Melainkan akan Saya bahas mulai dari definisi.

Biaya Variabel Per Unit Adalah Cara Menghitung Biaya Tetap Dan Biaya Variabel Jurnal / Dengan

Biaya Per Unit = (Total Biaya Tetap + Total Biaya Variabel) / Total Unit yang Diproduksi. Biaya per unit berarti lebih dari berapa biaya untuk memproduksi satu unit produk Anda. Ini juga mewakili titik impas Anda, atau minimum Anda harus menjual item sebelum Anda dapat mulai menghasilkan keuntungan. Misalnya, jika biaya perunit produk Anda.

Cara Menghitung Biaya Variabel Per Unit Dalam Bep Break Even Point Definisi Jenis Dan Cara

If the total variable expenses incurred were $100,000, the variable cost per unit is $100.00 per hour. Variable Cost Per Unit = $100,000 ÷ 1,000 = $100.00; If the consulting company continues to scale and the number of clients (and hours billed) increases, the variable costs also increase — which can place downward pressure on the company.

Variable Cost Definition, Formula and Calculation Wise

What is Variable Cost Per Unit? Ahead of discussing how to calculate variable cost per unit, let us begin by defining variable cost. Variable cost is a corporate expense that changes in proportion to production output. It changes with an increase or decrease in the amount of goods or services produced or sold.

Contoh Soal Biaya Per Unit

Factory utilities - $6,500 per month. To calculate variable expenses for the year, the manager must multiply each expense by 12 to get the yearly costs. Raw materials - $4,500 x 12 = $54,000. Packaging and shipping - $2,800 x 12 = $33,600. Direct labor - $7,200 x 12 = $86,400. Overtime wages - $1,500 x 12 = $18,000.

Solved Compute the variable cost per unit using the highlow

Variable Cost Per Unit. The variable cost per unit is the amount of labor, materials, and other resources required to produce your product. For example, if your company sells sets of kitchen knives for $300 but each set requires $200 to create, test, package, and market, your variable cost per unit is $200. Number of Units Produced

Biaya Variabel Per Unit Rumus / Rumus dan Cara Menghitung BEP (Break Even Point) Bisnis Biaya

Untuk menghitung biaya variabel, manajer proyek atau pemilik bisnis menggunakan angka-angka ini: Biaya bahan langsung (elemen pemanas, kipas, motor, pelindung panas, sakelar, steker terpolarisasi) per unit: 80.000; Biaya tenaga kerja langsung (peralatan otomatis dan tenaga kerja manual) per unit: 40.000; Biaya tetap (overhead) per unit: 20.000

Inilah Informasi Cara Menghitung Biaya Variabel Unit Terlengkap Referensi Biaya 2021

Biaya variabel per unit dapat dihitung sebagai =, yaitu v adalah biaya variabel per unit, V adalah biaya variabel total, dan Q adalah kuantitas (quantity) produksi. Sebagai contoh, jika bisnis di atas memproduksi 500.000.000 unit produk di tahun tersebut, biaya variabel per unit adalah atau ,.

Biaya Variabel Per Unit Rumus PPT Harga Pokok Variabel ( Variable Costing ) PowerPoint 27.

Tidak seperti biaya tetap, yang tidak berubah per setiap unit produksi, biaya variabel terkait langsung dengan setiap produk yang dihasilkan perusahaan atau jasa yang diberikannya. Memahami perbedaan antara biaya variabel dan biaya tetap akan memungkinkan Anda menentukan harga produk Anda dengan tepat atau memberikan saran bisnis yang lebih baik.