Cara Membuat EFIN Online Tanpa ke Kantor Pajak YouTube

Berikut tata cara mendapatkan EFIN secara online: Sebagai wajib pajak yang ingin mendapatkan EFIN secara online silakan akses laman efin.pajak.go.id. Siapkan NPWP, lalu klik "Lanjutkan". Beri akses untuk menggunakan kamera pada perangkat telepon genggam atau komputer lalu klik "Lanjutkan". Muncul Disclaimer, lalu klik "Mulai Sekarang".

Cara Request EFIN Online untuk Lapor SPT di DJP Online

View your address on file, share account access and request a tax check. Employer identification number (EIN) Get your EIN online without calling, mailing or faxing a paper Form SS-4, Application for Employer Identification Number. Online Tax Calendar Track important business tax dates and deadlines right from your desktop.

Panduan Lengkap Cara Mendapatkan EFIN Online untuk Pajak Pribadi Qoala Indonesia

efin.pajak.go.id

¿Cómo tramitar el EFIN y formalizar tu negocio de TAXES?

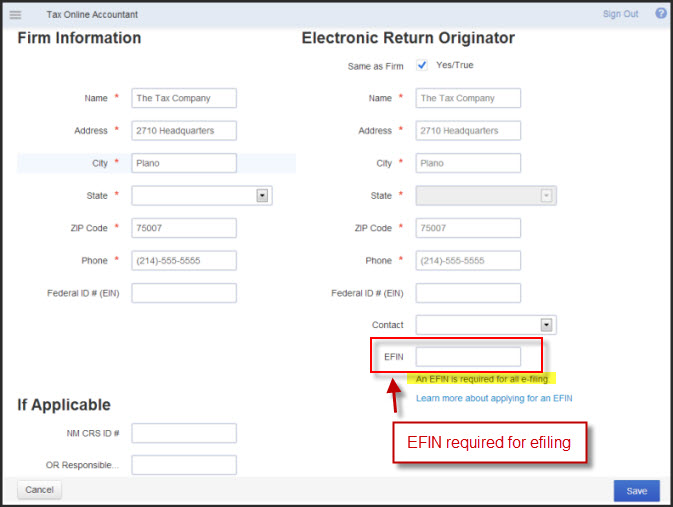

You may need to register for an Electronic Filing Identification Number (EFIN) and Preparer Tax Identification Number (PTIN). Learn why and how you can register. For more information or to speak with an Intuit tax consultant, please call (844) 824-7164.

Cara Mudah Aktivasi EFIN untuk Lapor Pajak Online

Saat swafoto, nomor NPWP dan NIK KTP harus terlihat karena akan diperiksa oleh petugas. Lalu, kirimkan email permohonan EFIN online dengan subjek email: 'PERMINTAAN NOMOR EFIN'. Untuk di kolom pesan, ketik nomor NPWP, Nama Lengkap, NIK, alamat tempat tinggal, alamat email wajib pajak, dan nomor handphone. Lampirkan foto formulir permohonan.

Apa Itu EFIN dan Bagaimana Cara Mendapatkan EFIN Secara Online?

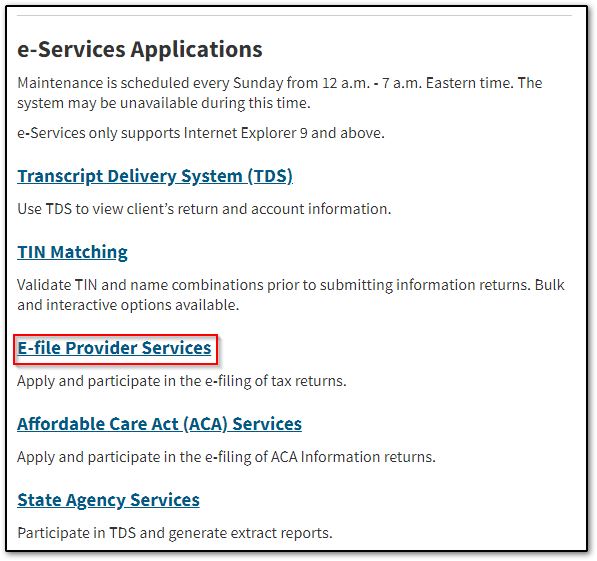

Information for tax professionals. Access online tools for tax professionals, register for or renew your Preparer Tax Identification Number (PTIN), apply for an Electronic Filing Identification Number (EFIN), and more.

EFIN Pajak Cara Membuat dan Mengaktifkan EFIN Online

On the Select Organization page, select the option next to your firm's name. Click the Application link. Click the e-File Application link. Click your firm name, then click Application Summary. At the bottom of the Application Summary, click the Print Summary link. Create a PDF of your e-file application summary by selecting Adobe PDF as the.

How to get your EFIN Application Summary from the IRS. Tax Hound Support

How to obtain an EFIN from the IRS. An EFIN is required for preparers to submit e-file returns to the IRS. The application process can take up to 45 days, so preparers are encouraged to begin the registration well in advance of tax season. Your tax program won't let the return to be e-filed if there is no EFIN entered in your software or if the.

EFIN Pajak Cara Membuat dan Mengaktifkan EFIN Online

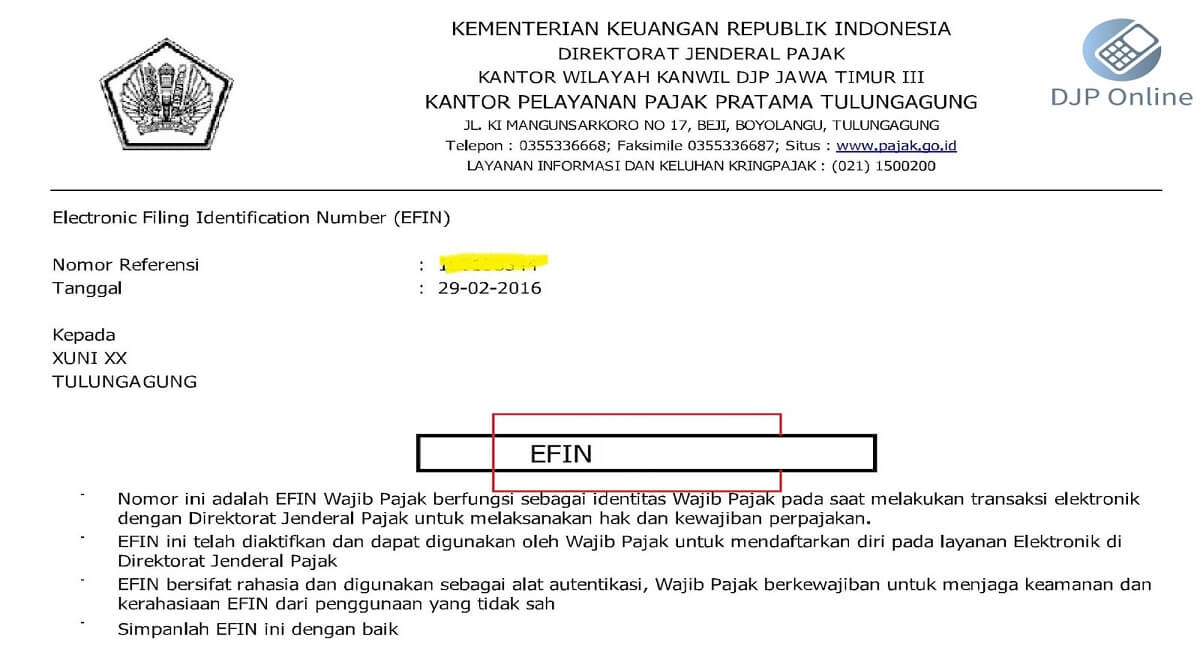

Pertama, cara daftar dengan unduh formulir permohonan EFIN di https://www.pajak.com dan cetak. Kedua, isi formulir sesuai dengan identitas, seperti: nomor pokok wajib pajak (NPWP), nama, tempat lahir, tanggal lahir, alamat e-mail, dan sebagainya. Pastikan Anda telah memilih atau ceklis kolom "Orang Pribadi" di bagian paling atas formulir.

Entering an EFIN PTIN and ERO PIN in the ProConnect Tax Online P... Accountants Community

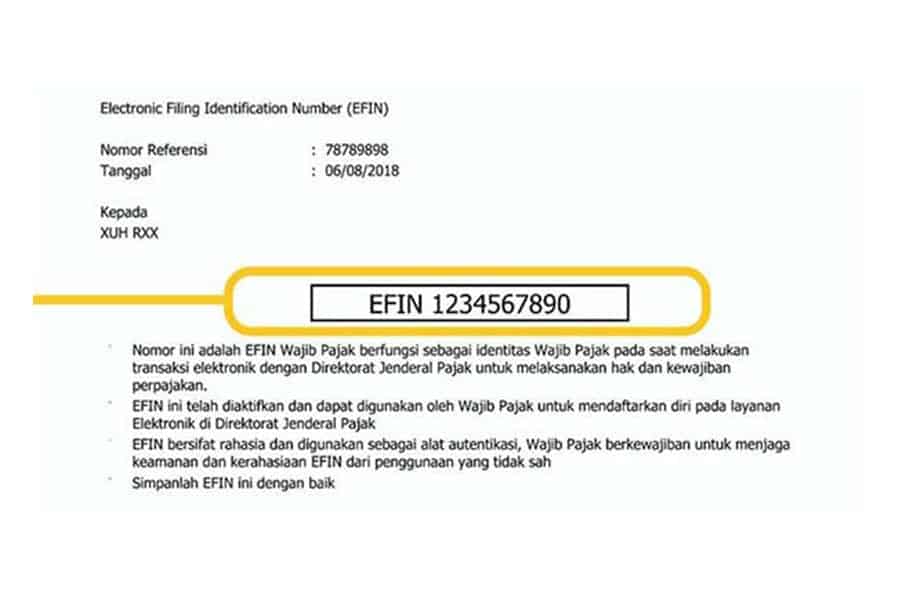

Infografik cara mendapatkan EFIN pribadi. Langkah-Langkah Mendaftar EFIN Pajak Pribadi. DJP memberikan dua pilihan bagi WP yang ingin mengajukan permohonan EFIN Pajak Pribadi ini, yakni secara offline dengan mendatangi langsung Kantor Pelayanan Pajak (KPP) dan permohonan EFIN Pajak secara online.. Tentu saja, pengajuan EFIN secara daring akan lebih simpel karena dapat dilakukan kapan pun dan.

What New Tax Preparers Need to Know About Getting an EFIN ⋆ Pronto Tax School

Step 1: Determine your eligibility. You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

CARA MUDAH PERMOHONAN EFIN SECARA ONLINE TERBARU 2020 YouTube

Free access to online products is only available by starting from IRS Free File. Eight private-sector partners will provide online guided tax software products this year to any taxpayer with an Adjusted Gross Income (AGI) of $79,000 or less in 2023. One partner will offer a product in Spanish.

Cara Mendapatkan Nomor EFIN Online Menggunakan Email Digital Poin

Step 1 - Create an IRS e-services account. This account will allow you to interact with the IRS electronically. This process can take several days, so plan accordingly. When you apply for this account, you will need to: Provide your full legal name, your social security number, your date of birth, a valid phone number, email address, and your.

Panduan Lengkap Daftar EFIN Online Daftar Cuma 10 Menit!

However, if you are a tax preparer building your own business, you must secure an EFIN for your practice. The Principal and Responsible Official from your practice should sign up for the EFIN. TIP: It takes 45 days for the IRS to process EFIN applications. The earlier you apply for an EFIN, the better. The IRS has been campaigning to move all.

Use an IRS eServices Online Account for EFIN Application or Status Check

requirements. Once approved, you will receive an acceptance letter from the IRS with your Electronic Filing Identification Number (EFIN). Maintaining your . e-file. application . Once you have been approved and receive your EFIN, it is important that you keep your e-file Application up to date. This includes: 1. Reviewing your . e-file

5 Tahap Cara Daftar EFIN Online dan Fungsinya Varia Katadata.co.id

Sebelum daftar EFIN online via email, cek dulu alamat email KPP yang akan dikirimi permintaan daftar EFIN online di sini . Jika sudah mendapatkan alamat email KPP dimana Anda terdaftar, silakan ikuti cara mendapatkan EFIN online melalui email seperti berikut ini: Buka email dan pilih kirim email. Tulis email dengan tujuan email KPP di mana Anda.