How to Calculate Quick Ratio 8 Steps (with Pictures) wikiHow

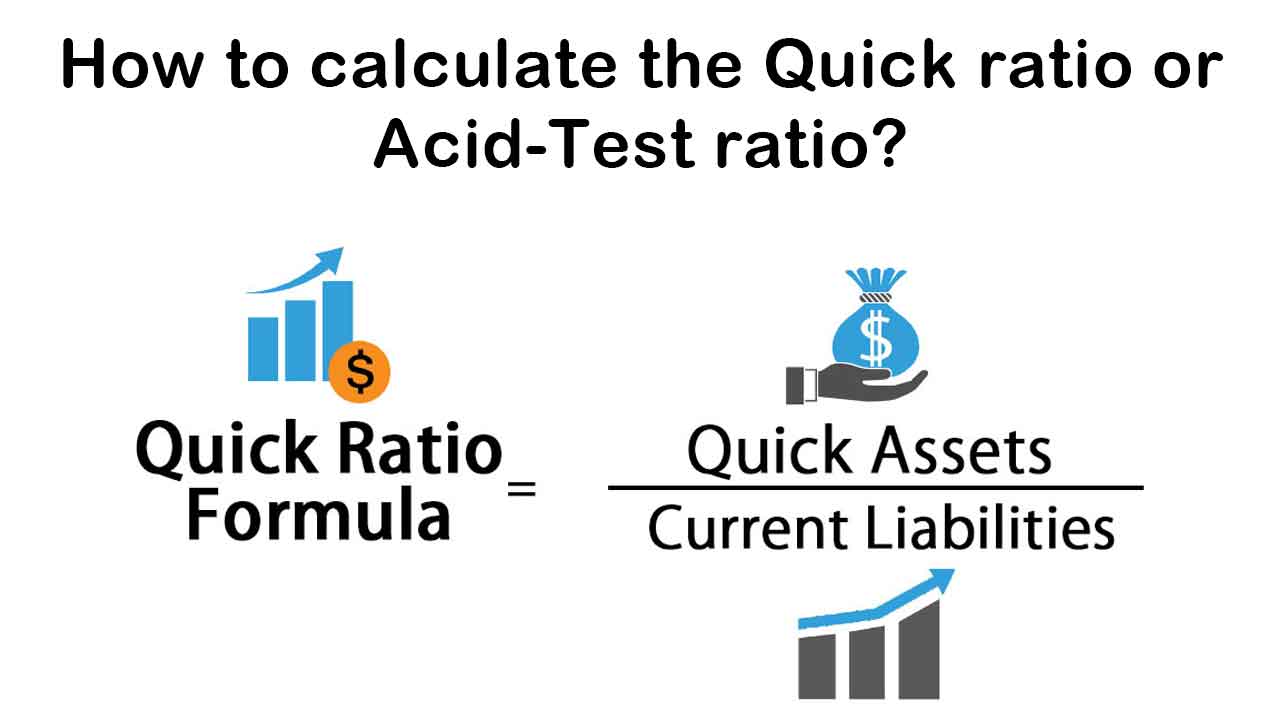

Rumus quick ratio yaitu membagi quick assets dengan current liabilities. Nilai quick ratio semakin tinggi berarti aset-aset paling likuid perusahaan mampu menjamin pelunasan semua utang jangka pendeknya. Quick ratio yang baik dan dapat diterima umumnya 1 kali (rasio 1:1), dan semakin bagus jika lebih dari itu..

The Quick Ratio Formula, What It Is, and How to Calculate It

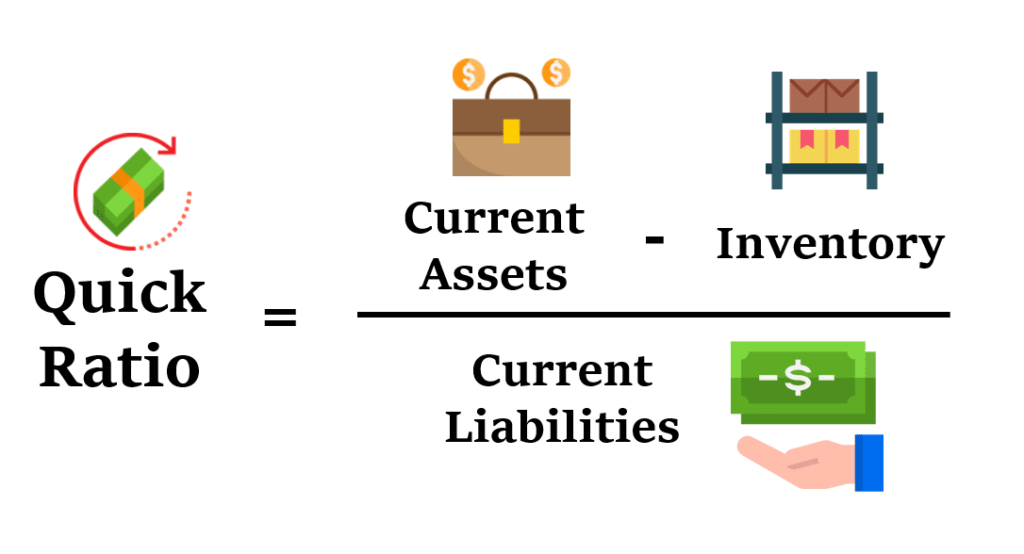

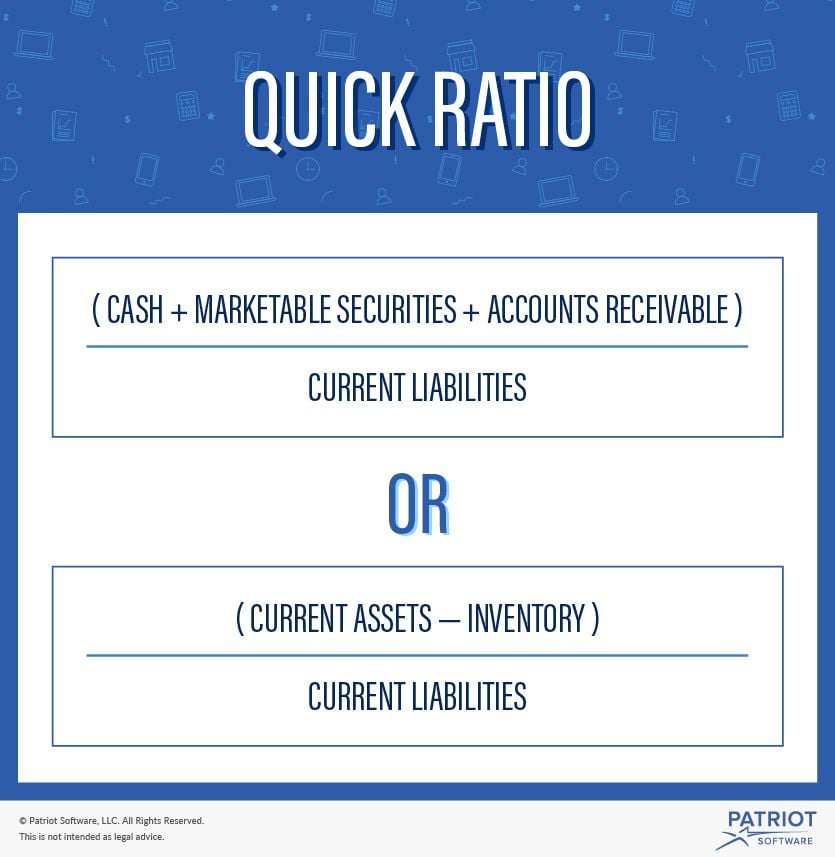

Quick ratio = (Kas dan setara kas + Investasi jangka pendek + Piutang usaha)/Liabilitas lancar; Quick ratio = (Aset lancar - Persediaan - Biaya dibayar dimuka) / Liabilitas lancar; Akun-akun dalam perhitungan di atas dapat kita temukan di neraca.. Kas dan setara kas mewakili aset yang paling likuid, yang mana dapat segera digunakan untuk membayar tagihan.

How to Calcuate the quick ratio Sharda Associates

The quick ratio, also known as acid-test ratio, is a financial ratio that measures liquidity using the more liquid types of current assets. Its computation is similar to that of the current ratio, only that inventories and prepayments are excluded. Quick Ratio Formula. The quick ratio (or acid-test ratio) is a more conservative measure of.

Quick Ratio (Rasio Cepat) Definisi, Rumus, Cara Menghitung InvestBro

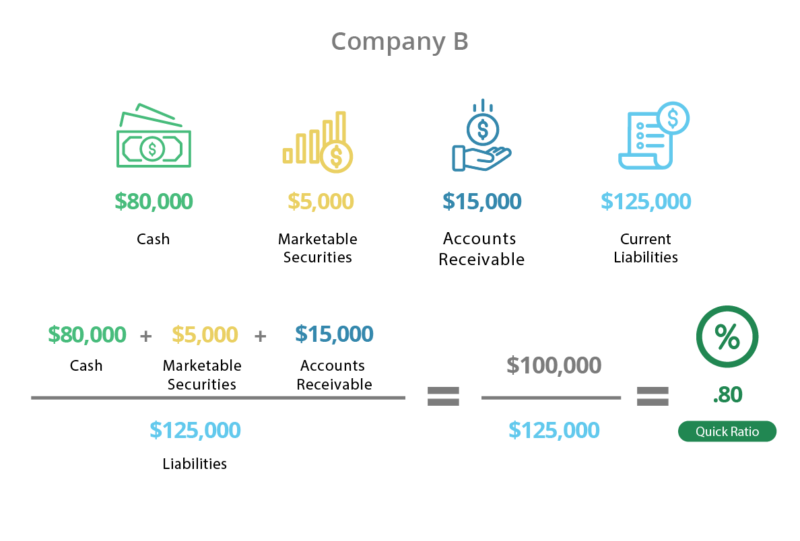

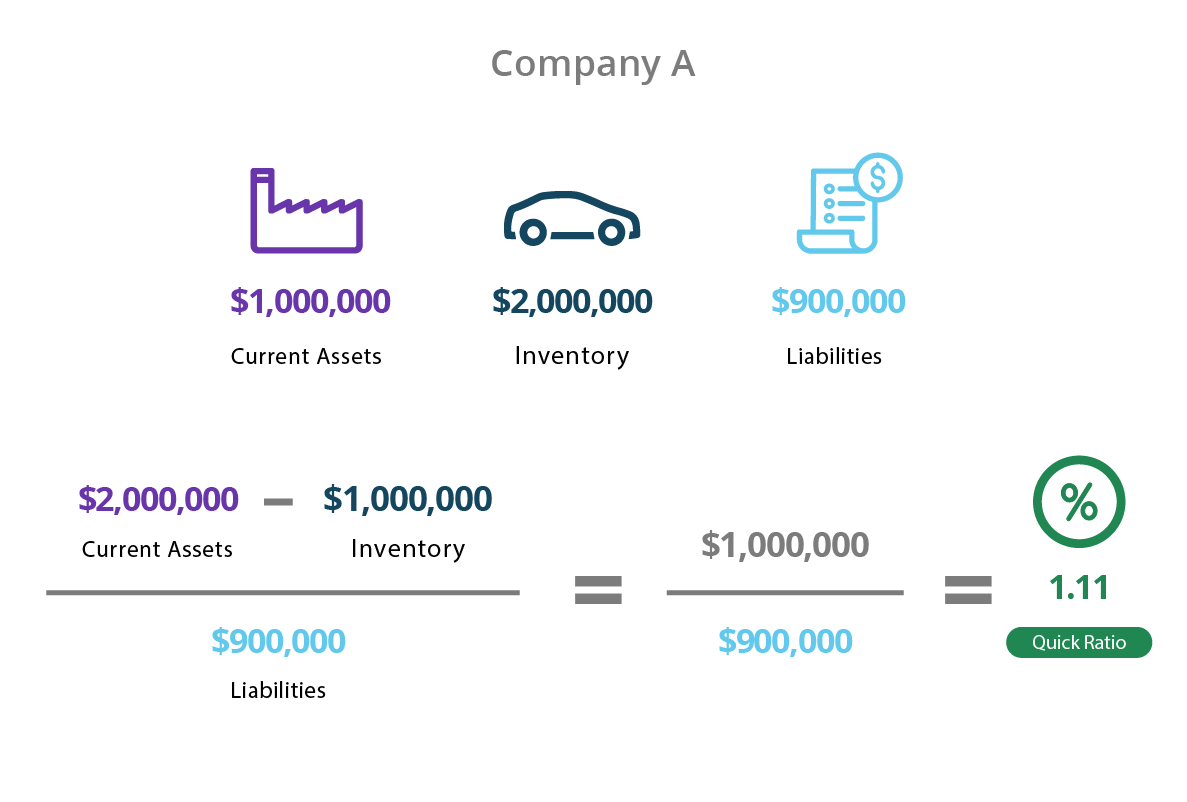

The formula for calculating the quick ratio is as follows. Quick Ratio = (Cash and Cash Equivalents + Accounts Receivable) ÷ Current Liabilities. For example, suppose a company has the following balance sheet data: Current Assets: Cash = $20 million. Marketable Securities = $10 million. Accounts Receivable (A/R) = $20 million.

What is Quick Ratio? Formula + Calculator

A ratio above 1 indicates that a business has enough cash or cash equivalents to cover its short-term financial obligations and sustain its operations. The formula in cell C9 is as follows = (C4+C5+C6) / C7. This formula takes cash, plus securities, plus AR, and then divides that total by AP (the only liability in this example).

Quick Ratio Meaning, Limitations, Calculation, Current Ratio vs Quick Ratio Glossary by

Quick Ratio = ($48.844B + $51.713B + $22.926B)/$105.718B. Note that all the current liabilities are included. Which boils down to a value of 1.17. This suggests that Apple has liquid assets worth about 17% more than its current debts (i.e., $1.17 of liquid assets for every $1.00 of current debt), which puts it in a healthy liquidity position.

Quick Ratio Formula & Definition InvestingAnswers

Rumus Quick Ratio. Sebelum masuk ke rumusnya, terdapat beberapa komponen penghitungan yang perlu Sobat OCBC NISP ketahui. Adapun komponen dalam penghitungan quick ratio adalah aktiva lancar dan kewajiban lancar. Aktiva lancar merujuk pada aset perusahaan, seperti kas, surat berharga, persediaan, piutang, dan beban bayar di muka..

Quick Ratio Formula How to Calculate Quick Ratio? (Example) YouTube

Rumus Rasio Cepat (Quick Ratio Formula) Untuk mencari nilai rasio cepat (quick ratio), Anda dapat menggunakan formula/rumus cara menghitung rasio cepat menurut Brigham & Houston (2013) berikut ini. Rumus rasio cepat (quick ratio) adalah (aset lancar - persediaaan) / liabilitas lancar. QR = (CA - Inventories) / CL. Keterangan: QR = quick ratio

Quick Ratio Formula Step By Step Calculation With Examples

Quick Ratio: Pengertian, Rumus, Contoh, Kelebihan dan Kekurangannya. Quick ratio atau biasa disebut rasio cepat atau acid-test rasio berfungsi sebagai indikator likuiditas jangka pendek perusahaan, atau kemampuannya untuk memenuhi kewajiban jangka pendeknya.. Dengan kata lain, ini menguji seberapa banyak perusahaan memiliki aset untuk melunasi semua kewajibannya.

Quick Ratio Formula Step By Step Calculation With Examples

Rumus Quick Ratio. Dalam perhitungannya, rumus quick ratio sebenarnya sangat sederhana. Berikut adalah rumus perhitungan rasio cepat. (Aset Lancar - Stok atau Persediaan) : Kewajiban Lancar. Yang dimaksud dengan aset lancar tersebut adalah kas, piutang, uang muka, maupun jenis aktiva lancar lainnya. Sementara kewajiban lancar adalah utang.

SaaS Quick Ratio 101 Calculation, Formula, Examples, and More Metrics

The Acid-Test Ratio, also known as the quick ratio, is a liquidity ratio that measures how sufficient a company's short-term assets are to cover its current liabilities. In other words, the acid-test ratio is a measure of how well a company can satisfy its short-term (current) financial obligations.

What is Quick Ratio? Formula + Calculator

Quick Ratio: The quick ratio is an indicator of a company's short-term liquidity, and measures a company's ability to meet its short-term obligations with its most liquid assets. Because we're.

Quick ratio formula, calculation and examples Financial

Mengetahui Cara dan Rumus Menghitung Quick Ratio. Rumus berikut digunakan untuk menghitung rasio cepat: Quick ratio = (kas + setara kas + investasi jangka pendek + piutang) dibagi (kewajiban lancar) Jika aset lancar perusahaan tidak tercatat di neraca, rumus berikut dapat digunakan untuk menghitung rasio cepat:

Rumus Quick Ratio RUANG BACA

Rumus Menghitung Quick Ratio. Anda dapat menghitung quick ratio dengan cukup sederhana.Mengutip dari Wallstreetmojo, berikut rumus yang dapat Anda gunakan:. Quick Ratio = Quick Assets / Quick Liabilities Penjelasan: Quick Assets. Quick assets atau aset lancar adalah aset yang mengacu kepada kepemilikan perusahaan dengan nilai yang dapat dikonversi menjadi uang tunai atau sudah dalam bentuk.

Quick Ratio Formula Step By Step Calculation With Examples

Quick Ratio Formula. The quick ratio formula is: Quick ratio = quick assets / current liabilities. Quick assets are a subset of the company's current assets. You can calculate their value this way: Quick assets = cash & cash equivalents + marketable securities + accounts receivable.

How To Calculate Quick Ratio Of A Company Haiper

Copied. The Quick Ratio, also known as the Acid-Test Ratio, is a financial metric used to assess a company's short-term liquidity and its ability to cover its immediate financial obligations.