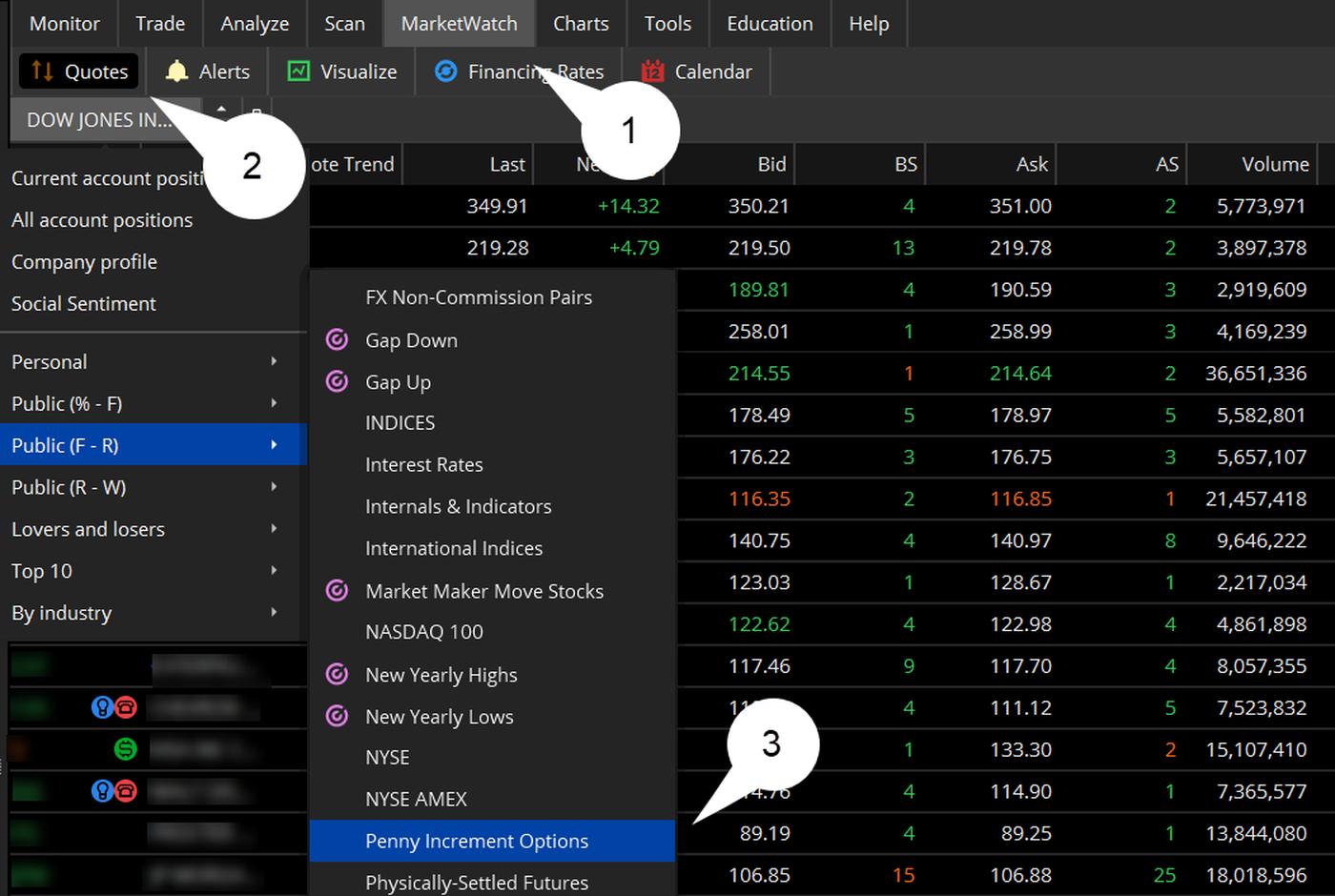

Stock Trading Strategy Frequent Trading Profit Loss Diagram Thinkorswim

Excess business losses and net operating losses. The net Section 475 losses and TTS business expenses are subject to the excess business loss (EBL) limitation for the tax year 2022. You can.

PROFIT SCREENSHOTS Intraday Star by Mittal Research Stock Trading Academy in Patiala

The maximum PSP amount is $37,500 on wages of $150,000 ($37,500 divided by 25% equals $150,000). The total limit for a Solo 401 (k) is $63,500 ($19,500 ED, $6,500 catch-up ED, and $37,500 PSP). LLC taxed as a partnership. A TTS trader can organize a spousal-member LLC and file as a partnership.

4 Easy Steps To Stay Profitable.. Forex brokers, Relationship management, Technical analysis tools

by Toby Mathis. Updated October 5, 2021. If you buy and sell securities as a primary source of income, you might be hoping to qualify for trader tax status (TTS). Filing taxes under this designation provides day traders with a number of benefits, such as writing off losses, business expenses, and employee benefit deductions for retirement plans.

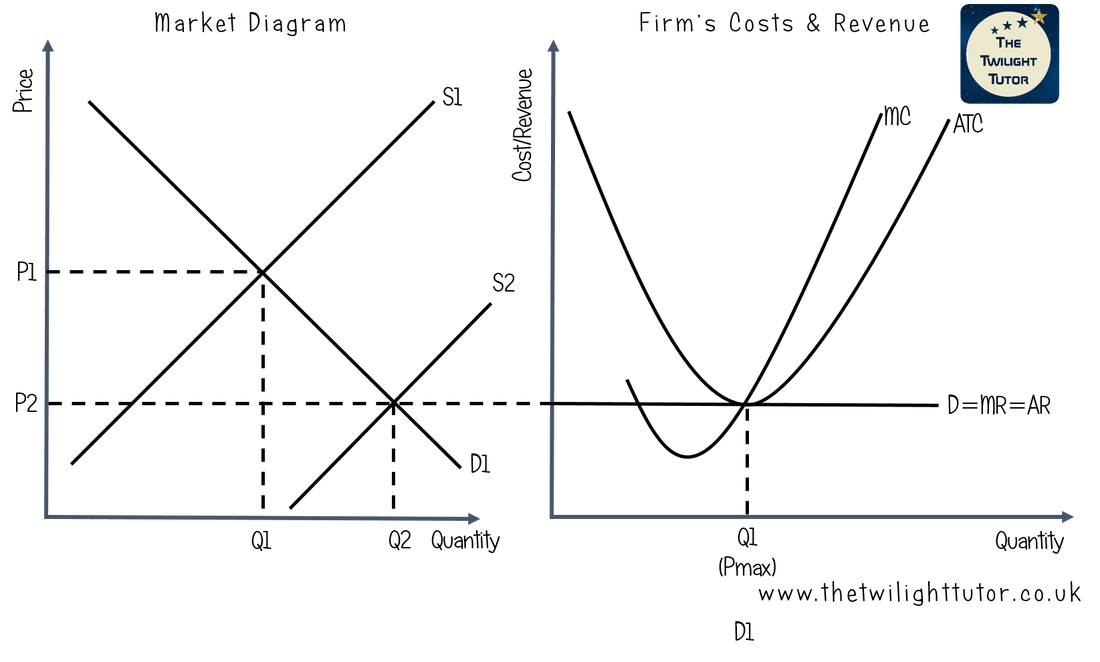

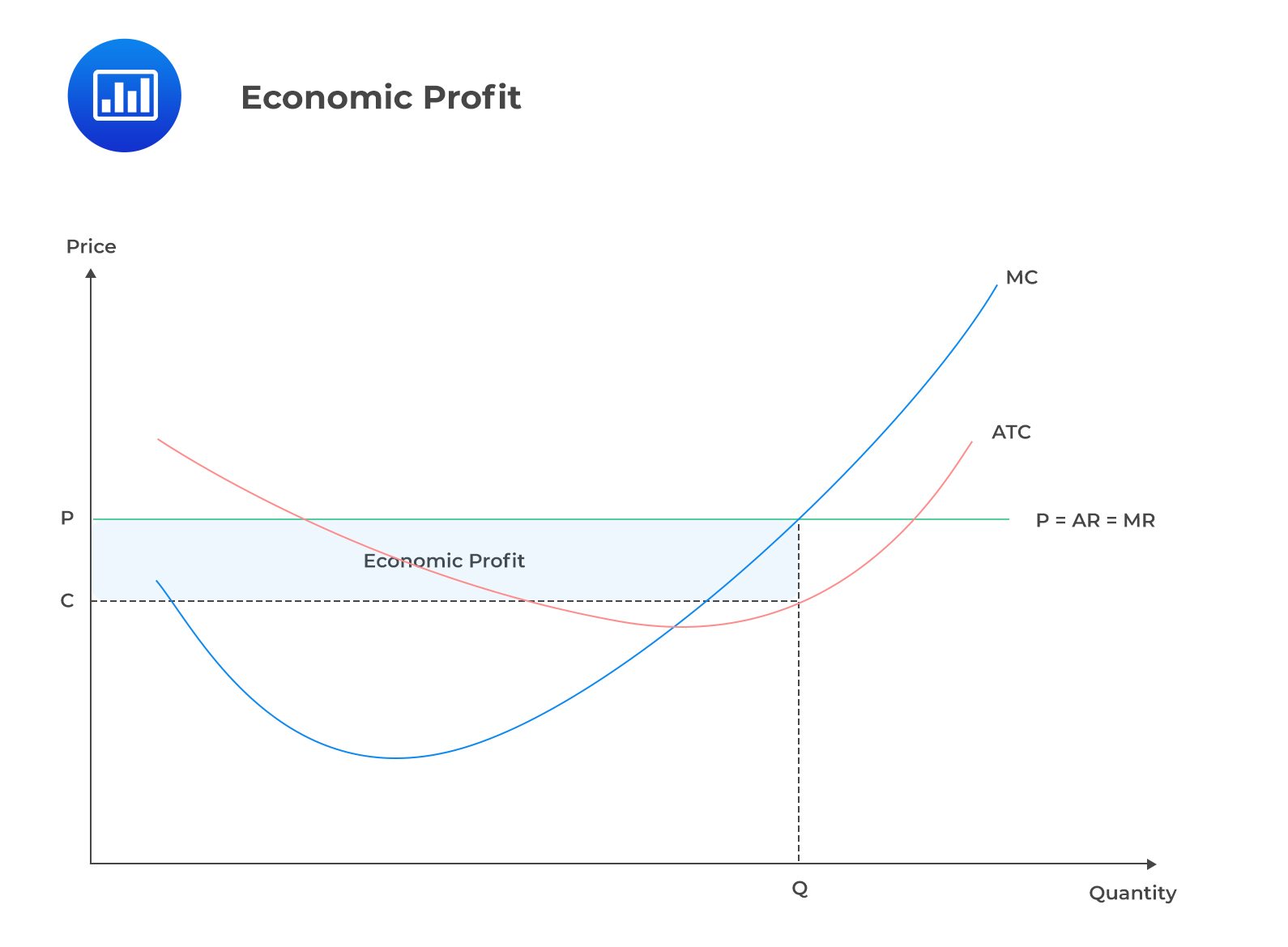

Profit Maximisation Economics tutor2u

Sole proprietorship. An individual TTS trader deducts business expenses and home office deductions on a Schedule C (Profit or Loss From Business - Sole Proprietorship), which is part of a Form.

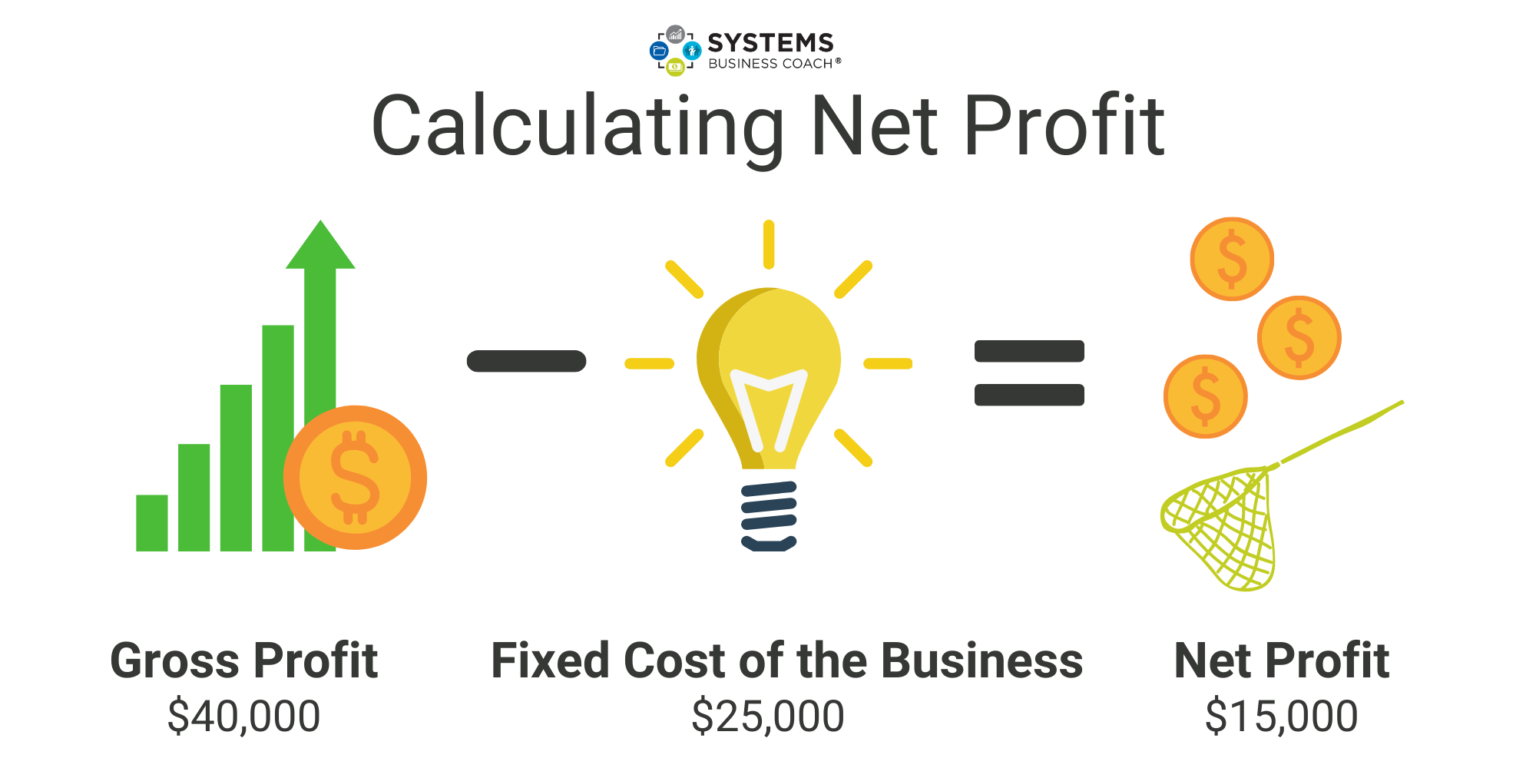

How to Easily Calculate and Increase your Business Profit SBC

Prices are subject to change. The best route is from Doobin to Hilltop. The highest-income route is from Anastazja's Point to Hordlo and vice versa. Private servers lower sell prices by 40%. TTS Profit Map.

5 Steps to MAXIMIZING Your Profit

Profit Voice is a low cost text to speech (TTS) web based software. Here's a demo of the voice in use.#shorts #profitvoice #tts

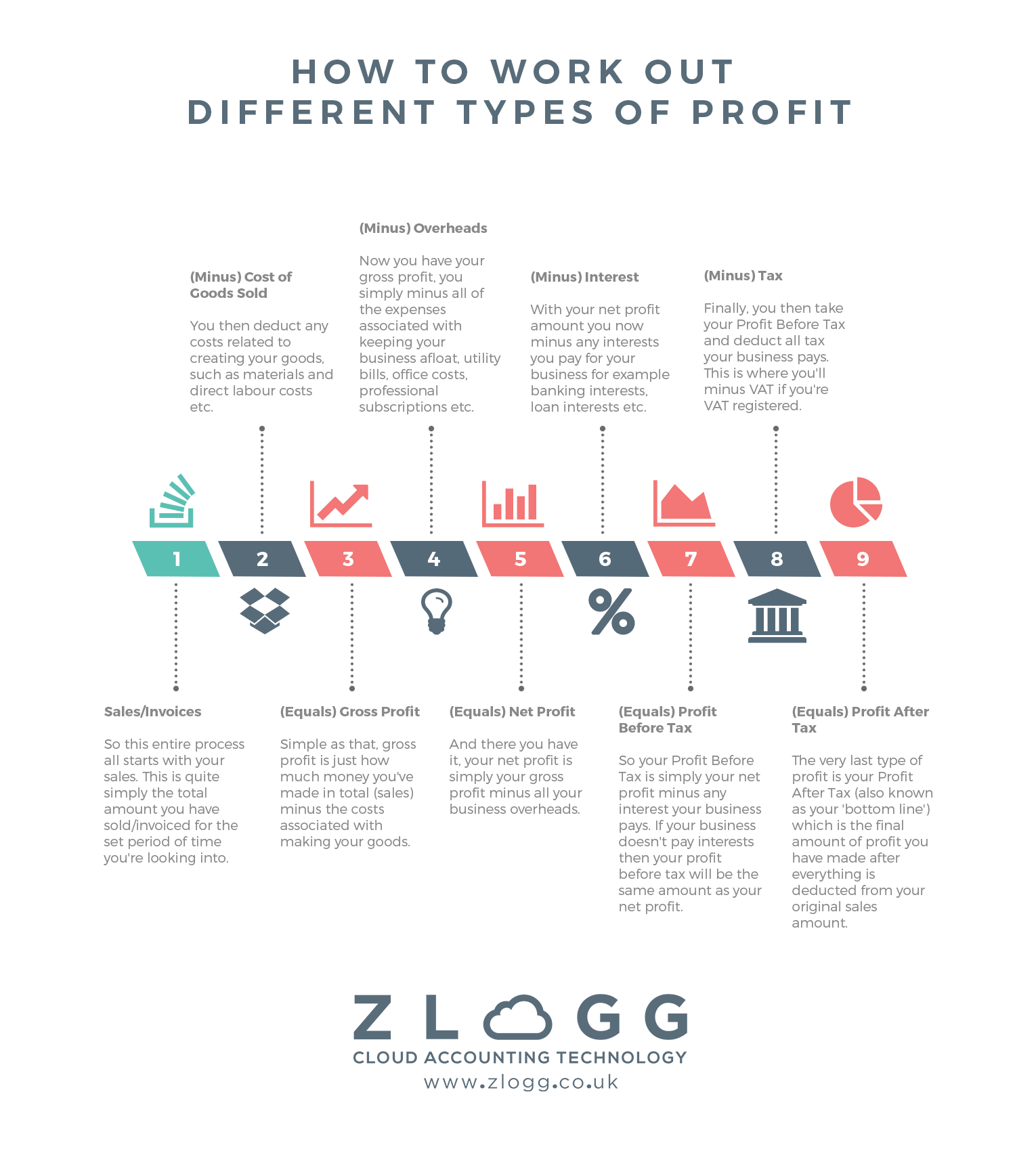

What are the Different Types of Profit? Profit Explained with Infographic

In December 2021, based on sufficient annual profits, a TTS S-Corp can pay maximum-required officer compensation of $154,000 to make the Solo 401(k) retirement plan contribution cap of $58,000.

Profit Trader indicadores e colocação de média móvel YouTube

The IRS specifies three main characteristics for TTS qualification: Seek to profit from trades; Trade frequently; Trade at a great volume; Since TTS status essentially means the IRS is treating the activities of a day trader like a business, that trader has to actually operate like a business. This means working almost every market day for.

What is Supernormal Profit? The Twilight Tutor

Solo 401(k) profit-sharing plan. Consider a 25% deductible Solo 401(k) profit-sharing plan (PSP) contribution if you have sufficient trading gains. Increase payroll in December 2022 for a performance bonus. You don't have to pay into the retirement plan until the due date of the S-Corp tax return (including extensions by September 15, 2023).

Maximizing Your Profit Potential

Traders report their business expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship). Commissions and other costs of acquiring or disposing of securities aren't deductible but must be used to figure gain or loss upon disposition of the securities. See Topic no. 703, Basis of assets. Gains and losses from selling.

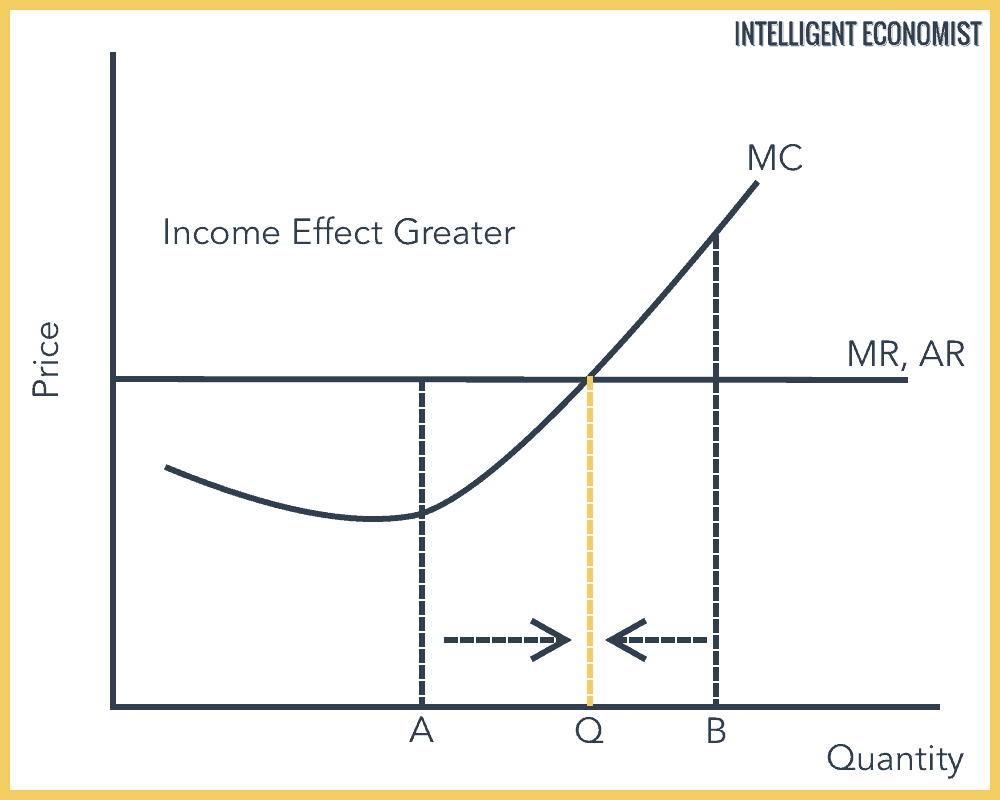

Perfect Competition Introduction to Microeconomics

Profit Voice is a text to speech (TTS) software that outputs audio mp3 files of speech from inputted text. It can also translate text to different languages.

Profit and Loss Report [English] YouTube

The best text-to-speech software makes it simple and easy to convert text to voice for accessibility or for productivity applications. Best text-to-speech software: Quick menu. 1. Best overall. 2.

IPhone With Trading Profits సాధ్యమా?How I made 130 Profits by Buying Options TTS YouTube

Text to speech (TTS) is a technology that converts text into spoken audio. It can read aloud PDFs, websites, and books using natural AI voices. Text-to-speech (TTS) technology can be helpful for anyone who needs to access written content in an auditory format, and it can provide a more inclusive and accessible way of communication for many people.

Price, Marginal Cost, Marginal Revenue, Economic Profit, and the Elasticity of Demand

View Financial Supplement (Excel) New York - Citigroup Inc. today reported net income for the fourth quarter 2022 of $2.5 billion, or $1.16 per diluted share, on revenues of $18.0 billion. This compares to net income of $3.2 billion, or $1.46 per diluted share, on revenues of $17.0 billion for the fourth quarter 2021.

How to Read a Profit and Loss Statement SMI Financial Coaching

TTS business expenses. If you qualified for TTS in 2023, you could claim business expenses on Schedule C. No IRS election was required. Schedule C is part of an individual tax return (Form 1040).

🏷️ Explain profit maximization. Profit Maximization. 20221023

ProfitVoice Review: Profit Voice Text To Speech Software Toolhttps://bit.ly/3wIuaNQ - Get ProftVoice HereHello and welcome to my Profit Voice review. In this.