PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

Regulation PER 22/PJ/2013 has been published by the Indonesia's Directorate General of Taxation (DGT) on 30 May 2013 to provide guidelines for audits of taxpayers with related-party relationships and repealed the regulation KEP-01/PJ 07/1993 which also provided the same guidelines regarding transfer pricing. According to the new regulation the use of data from multiple-year on both

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

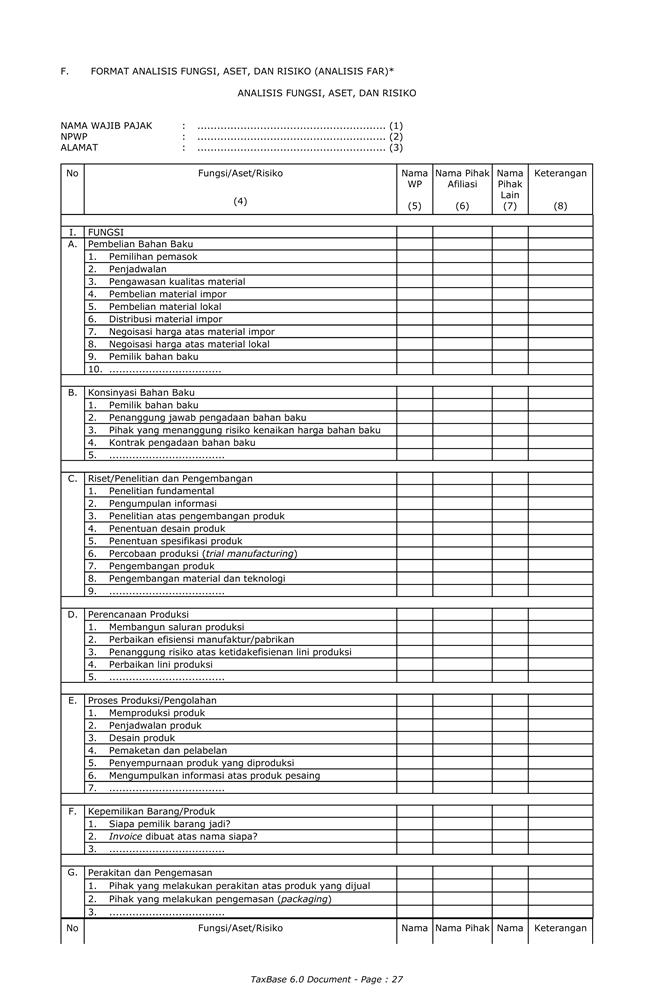

a similar concept since 2013, which requires the align-ment of functions and risks with remuneration (DGT Regulation PER-22/PJ/2013). However, the mechanism for performing such alignment in the case of deviation between functions, risks and remuneration has not been spelt out explicitly in the regulation.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

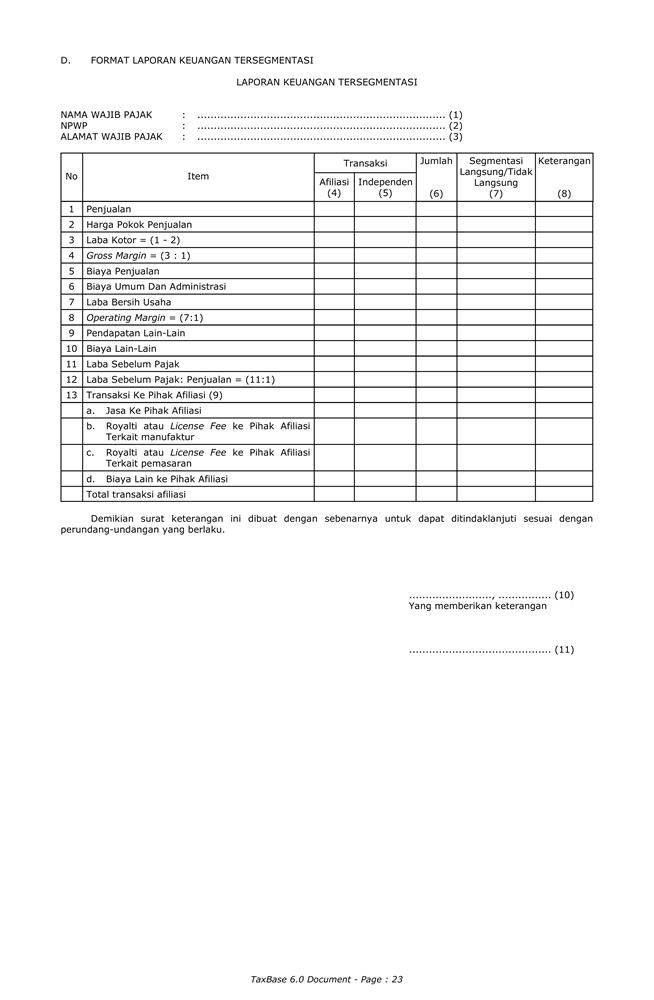

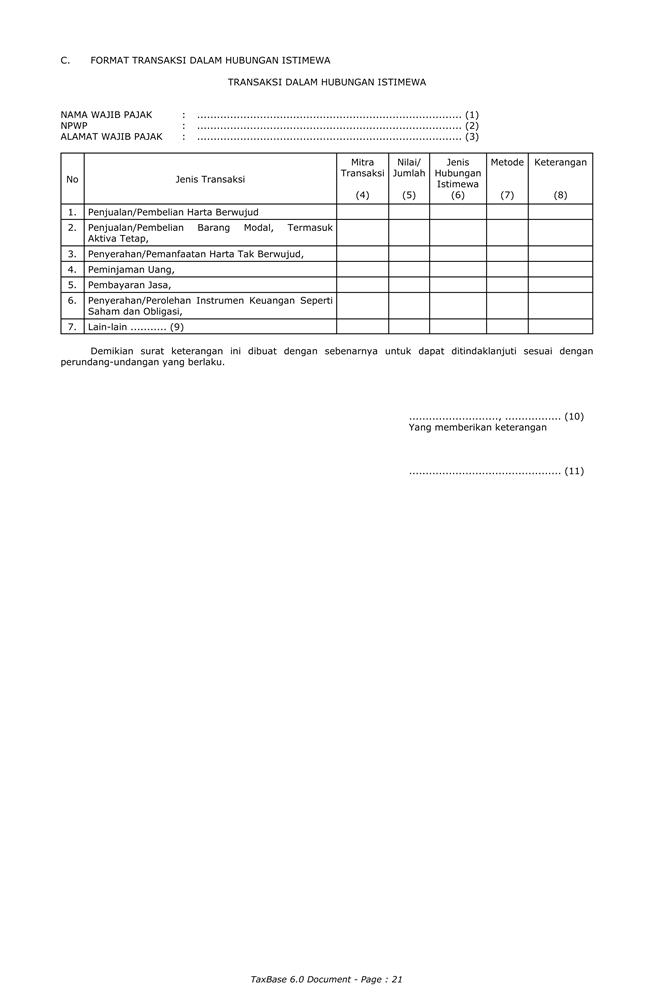

DGT Regulation PER-22/PJ/2013 regarding transfer pricing audit guidelines further specifies the types of transactions covered under Indonesian transfer rules, which include transactions on:

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

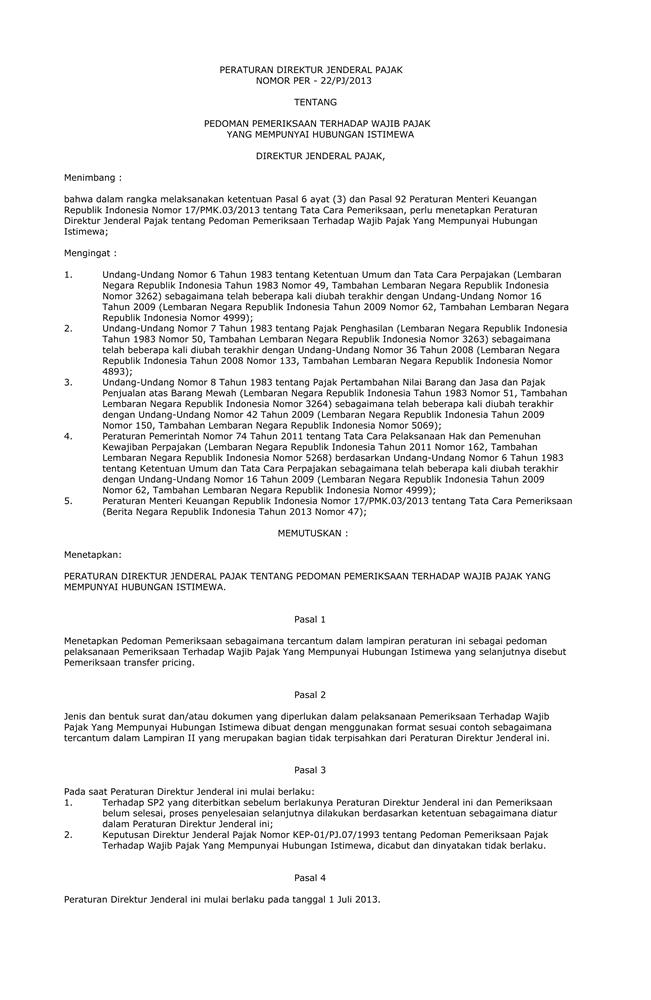

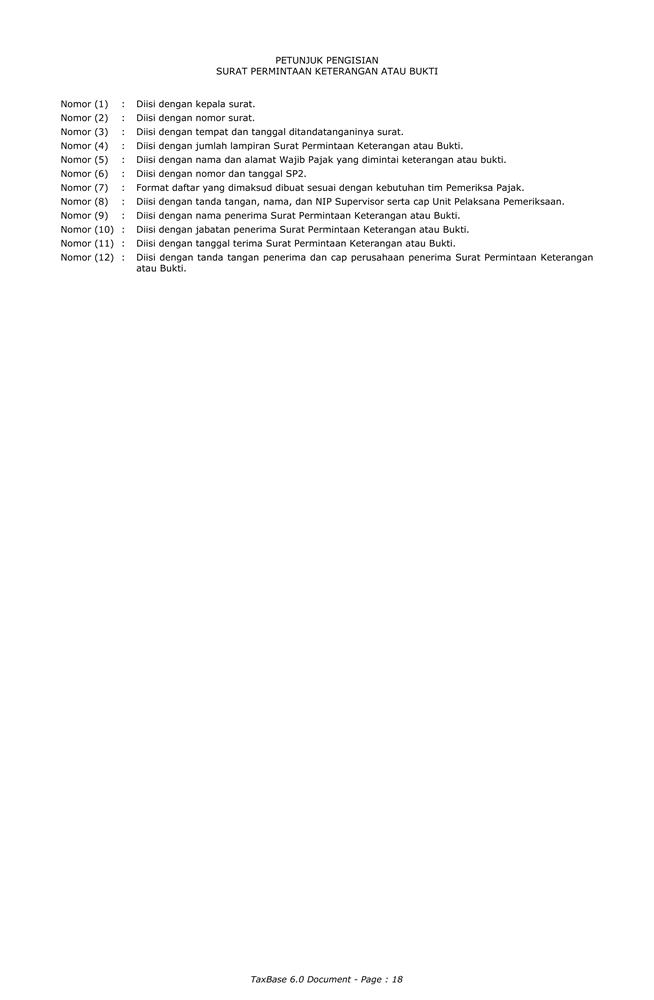

Pengambilan dokumen ini yang dilakukan tanpa ijin adalah tindakan ilegal. PERATURAN DIREKTUR JENDERAL PAJAK. NOMOR PER - 22/PJ/2013. TENTANG. PEDOMAN PEMERIKSAAN TERHADAP WAJIB PAJAK YANG MEMPUNYAI HUBUNGAN ISTIMEWA.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

regarding tax audit procedures for taxpayers with related party transactions. PER-22 revokes DGT Decision No.KEP-01/PJ.07/1993 (KEP-01) regarding the same subject. PER-22 is effective from 1 July 2013 and is applicable to prospective Tax Audit Instruction (SP2) and SP2 for which tax audit proceedings have not been concluded yet.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

NOMOR PER - 22/PJ/2013 TENTANG PEDOMAN PEMERIKSAAN TERHADAP WAJIB PAJAK YANG MEMPUNYAI HUBUNGAN ISTIMEWA DIREKTUR JENDERAL PAJAK, Menimbang : bahwa dalam rangka melaksanakan ketentuan Pasal 6 ayat (3) dan Pasal 92 Peraturan Menteri Keuangan Republik Indonesia Nomor 17/PMK.03/2013 tentang Tata Cara Pemeriksaan, perlu menetapkan Peraturan

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

The Director General of Tax ("DGT") recently issued a new Circular No.SE-50/PJ/2013 ("SE-50"or the "Circular") effective 24 October 2013, to provide technical guidelines on transfer pricing audits. The legal basis of this Circular is DGT Regulation PER-22/PJ/2013 ("PER-22") which was issued earlier this year in relation to the.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

Keputusan Direktur Jenderal Pajak Nomor KEP-01/PJ.07/1993 tentang Pedoman Pemeriksaan Pajak Terhadap Wajib Pajak Yang Mempunyai Hubungan Istimewa, dicabut dan dinyatakan tidak berlaku. Pasal 4. Peraturan Direktur Jenderal ini mulai berlaku pada tanggal 1 Juli 2013. Ditetapkan di Jakarta. pada tanggal 30-05-2013. DIREKTUR JENDERAL PAJAK,

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

22/PJ/2013 (PER-22/2013) and Circular Letter No. 50/PJ/2013 (SE-50/2013). There were no specific transfer pricing provisions issued after 2013 until PMK-22/2020 was released. Even though PMK-22/2020 is titled as an APA regulation, it encompasses two major chapters, which are the administration of APA itself and an additional transfer pricing.

Tips dan Cara Pengisian Form PER22/PJ/2013 untuk Wajib Pajak yang Mempunyai Hubungan Istimewa

Peraturan Pajak PERATURAN DIREKTUR JENDERAL PAJAK NOMOR : PER - 22/PJ/2013 TENTANG PEDOMAN PEMERIKSAAN TERHADAP WAJIB PAJAK YANG MEMPUNYAI HUBUNGAN ISTIMEWA DIREKTUR JENDERAL PAJAK, Menimbang: bahwa dalam rangka melaksanakan ketentuan Pasal 6 ayat (3) dan Pasal 92 Peraturan Menteri Keuangan Republik Indonesia Nomor 17/PMK.03/2013tentang Tata Cara Pemeriksaan, perlu menetapkan Peraturan.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

NOMOR PER-22/PJ/2013 TENTANG PEDOMAN PEMERIKSAAN TERHADAP WAJIB PAJAK YANG MEMPUNYAI HUBUNGAN ISTIMEWA . www.peraturanpajak.com [email protected] Lampiran I Peraturan Direktur Jenderal Pajak Nomor : PER- /PJ/2013 Tanggal : Mei 2013 BAB I PENDAHULUAN A. Perdagangan Internasional dan Perusahaan Multinasional.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

JAKARTA, DDTCNews - Pengawasan serta pemeriksaan terhadap transaksi dengan hubungan istimewa merupakan salah satu upaya otoritas pajak dalam mendeteksi ketidakpatuhan dari wajib pajak. Di Indonesia, peraturan terkait dengan pemeriksaan transfer pricing diatur melalui PER-22/PJ/2013 tentang Pedoman Pemeriksaan terhadap Wajib Pajak yang Mempunyai.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

3 DGT Regulation PER-22/PJ./2013 and Circular letter SE-50/PJ./2013. 4 Ministry of Finance Regulation No. 17/PMK.03/2013 as last amended by Ministry of Finance Regulation No. 18/PMK.03/2021.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

Created Date: 5/31/2013 11:58:02 AM

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

Issue Date: 30th May 2013.. PER-22/PJ/2013 Law Status: [Subscribers Only] Updated Status: [Subscribers Only] This legislation and/or case is revokes the following legislation and/or cases: [Subscribers Only] Legal Centric English Translation Available: Yes. Document; Timeline.

PERATURAN DIREKTUR JENDERAL PAJAK NOMOR PER 22/PJ/2013 TP Peraturan PT. HBMS Consulting

Keputusan Direktur Jenderal Pajak Nomor KEP-01/PJ.07/1993 tentang Pedoman Pemeriksaan Pajak Terhadap Wajib Pajak Yang Mempunyai Hubungan Istimewa, dicabut dan dinyatakan tidak berlaku. Pasal 4. Peraturan Direktur Jenderal ini mulai berlaku pada tanggal 1 Juli 2013. Ditetapkan di Jakarta. pada tanggal 30-05-2013. DIREKTUR JENDERAL PAJAK,