OCBC offers lower mortgage rate — but for just 15 days TODAY

Consolidate your outstanding credit card and personal loans across multiple financial institutes into one fixed monthly repayment with OCBC. Secure a personal loan in Singapore with OCBC's low interest rates and flexible repayment options. Choose from a range of affordable loan solutions.

How To Repay Your OCBC Student Loan Financially Independent Pharmacist

ExtraCash Loan. Get the extra cash for all your needs and enjoy affordable monthly repayments with your choice of loan tenor. Whether it's for refurbishing an old home or for a holiday treat for the family, ExtraCash Loan lets you get up to 4 times your monthly income easily today. Application eligibility: Age 21 and above. For Singaporean.

OCBC Bank ShaunniSaarah

Then, OCBC reached out in 2023 and granted N&E Innovations a green financing loan. "That really helped our journey. Without that first loan, we wouldn't be where we are today," said Gan.

OCBC CashonInstalments Monthly Instalment Loans Singapore

The OCBC Women Entrepreneurs Programme builds on a similar initiative managed by OCBC Indonesia. Since the launch in 2020, OCBC Indonesia has supported about 1,400 women entrepreneurs running micro, small and medium sized enterprises (MSMEs) under its Women Warriors Programme with over S$300 million (IDR3.5 trillion) in loans disbursed.

OCBC Personal Loan YouTube

Study Loans. Overseas Student Programme Loans. Visit the SMU FRANK outlet or any OCBC branch with your guarantor to apply for your MOE TFL, SL and/or OSP at: 70 Stamford Road #B1-43 Singapore Management University (Li Ka Shing Library) Singapore 178901.

OCBC CashonInstalments Monthly Instalment Loans Singapore

All three local banks reported weak loan growth in the fourth quarter of 2023. DBS and OCBC's gross loans fell by 1% compared to the previous quarter, while UOB's gross loans rose by 1% compared to the previous quarter. OCBC and UOB expect low single-digit loan growth in 2024, reflecting low appetite for new loans in a higher interest rate.

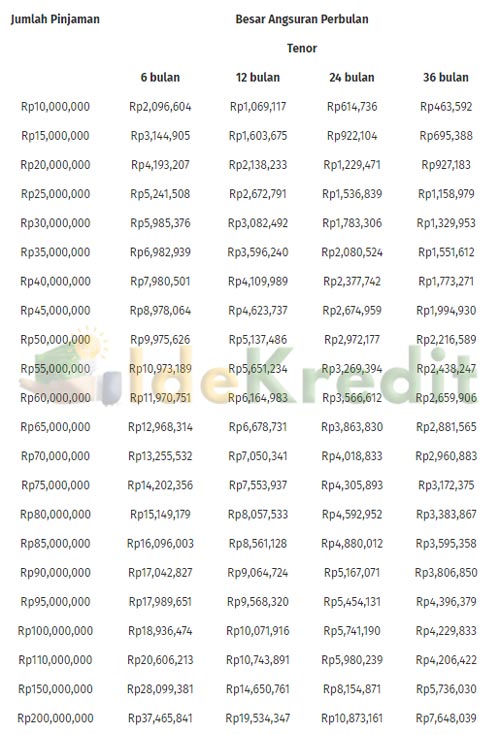

√ KTA Cash Loan OCBC NISP 2023 Syarat, Suku Bunga & Keuntungan

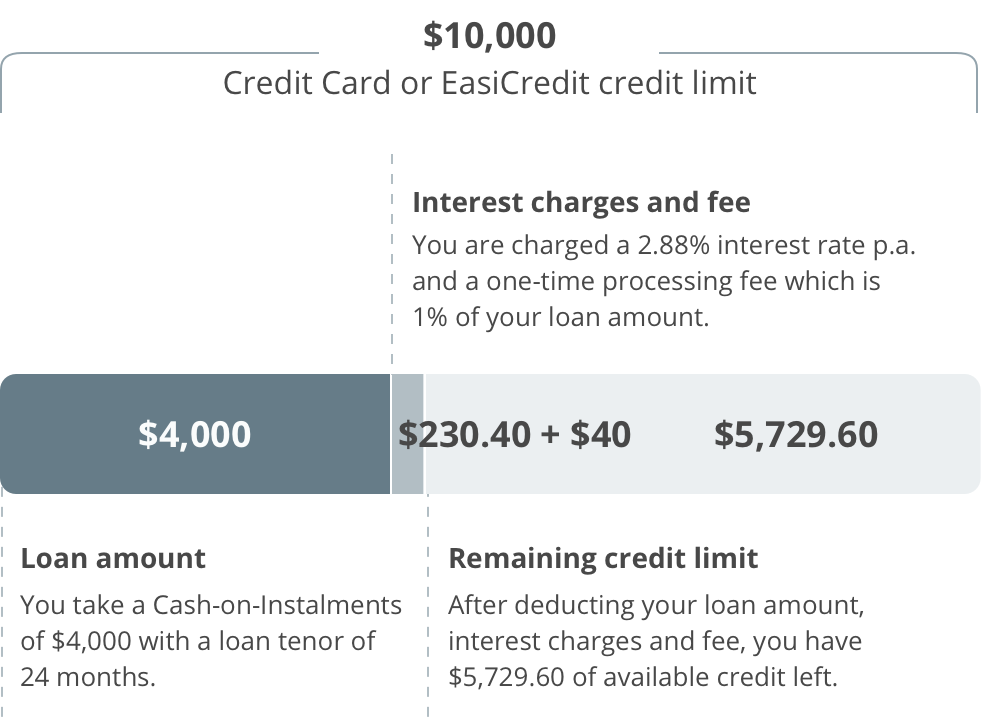

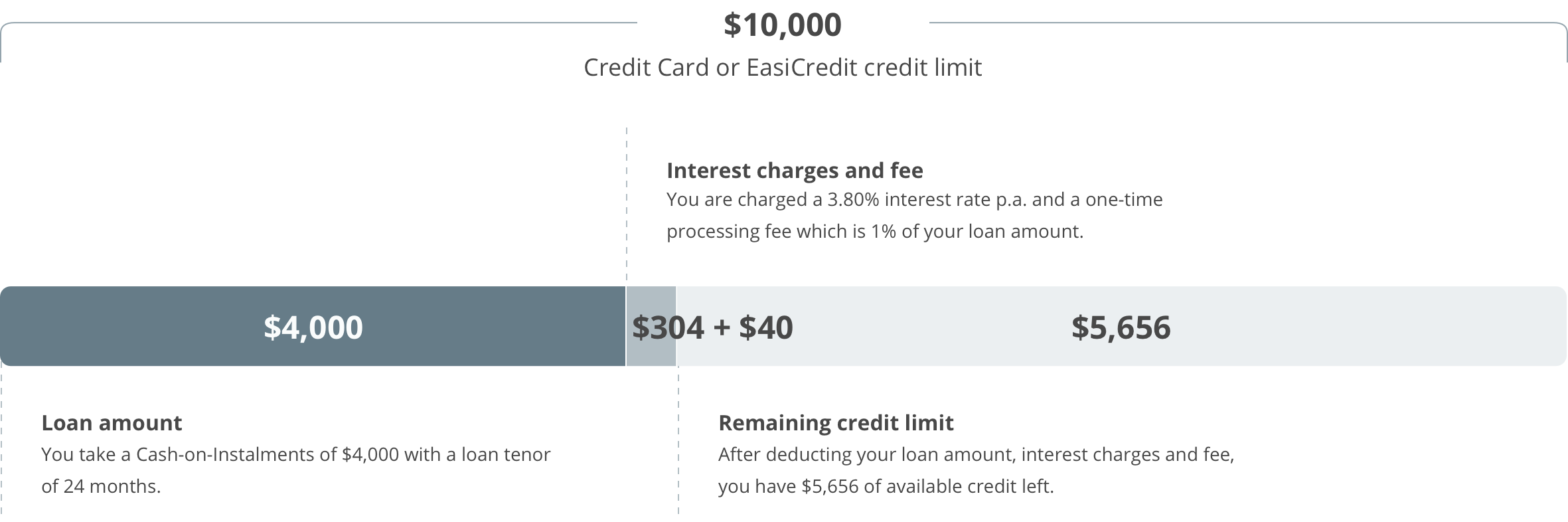

For Cash-On-Instalment on EasiCredit This offer is only open to EasiCredit Account holders with an annual income of S$30,000 and above. The minimum request amount is S$1,000 and interest on the loan amount is calculated based on front-end add-on method.

OCBC unveils 200,000 loans for small businesses Singapore Business Review

Jalankan semua rencana & wujudkan mimpimu bersama Cash Loan, pinjaman tunai dari OCBC NISP tanpa agunan dan tersedia dana tunai hingga Rp200 juta. Singapore Malaysia Hongkong.. This could negatively affect the Customer's application for future loan facilites or their existing loan facilites, either in OCBC or in other financial institution;

Ocbc Personal Loan Malaysia / Home Loan OCBC Singapore / If you want value, look no further

Today's OCBC Extra Cash interest rate trends in Singapore - As of Wednesday, December 27th, 2023, OCBC Extra Cash's annual interest rate stands at 5.42% with an effective interest of 12.11%.

OCBC Business Loan Singapore Guidelines Cash Mart Singapore

loan services. Estimated interest payable from Feb to May. S$637.30. Estimated interest payable post extension. S$6231.33. Estimated Interest payable. S$6,868.63. Make adjustments to your OCBC home, renovation or car loan easily with OCBC Bank's online loan services. Explore here.

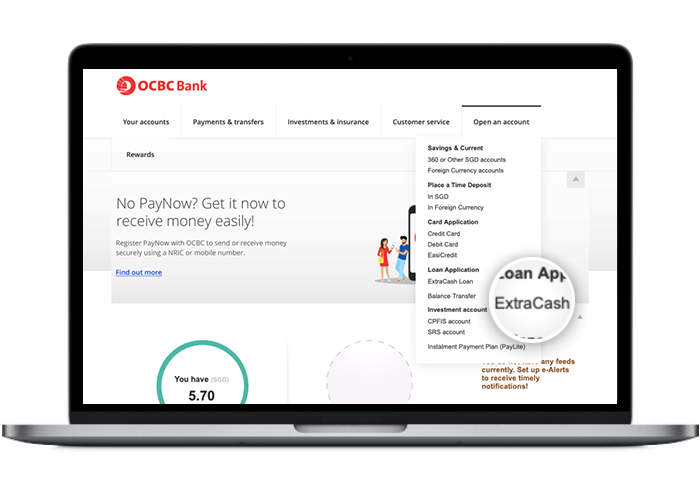

Apply for ExtraCash Loan Stepbystep guides for Digital Banking OCBC Singapore

OCBC Compare OCBC Personal Loan interest rates to other bank rates. Top 3 reasons to apply for OCBC ExtraCash Loan: Loan tenure from 12 to 60 months Borrow up to 6x monthly salary for annual income S$120,000 and above, 4x monthly salary for annual income S$30,000-S$119,999 and 2x monthly salary for annual income S$20,000-S$29,000 Make repayments easily via online or Mobile Banking funds.

Help & Support Home Loan Statement Guide OCBC Malaysia

The effective interest rate (EIR) of loan products on our site range from 6.5% p.a. to up to 20.0% p.a. The EIR of your loan will be dependent on the loan you apply for as well as your personal financial needs. For an example of a loan with 8.5% EIR, you would need to pay S$316/month for an S$10,000 Personal Loan with a loan tenure of 3 years.

OCBC's Home Loans What Was The OHR Rate All About? MoneySmart.sg

Best Private Student Loans; Best Student Loan Refinance;. Margin loan rates from 5.83% to 6.83%.. managing director of investment strategy at OCBC Bank in Singapore, said if the data come in.

Need cash quickly? Consider a Personal Loan from OCBC

36.00%. 29.80% (for customers with annual income S$20,000 - S$29,999) 36.00%. Get a line of credit for standby cash conveniently with OCBC EasiCredit. Choose the repayment amount and tenure of your outstanding balance. Instant approval via Myinfo.

Quick Guide OCBC iBanking in Singapore Cash Mart Singapore

OCBC charges some of the highest effective interest rates, ranging from 17.1 to 29.8%, for personal loans in Singapore. This makes the total cost of these loans more expensive than other banks. However, OCBC is 1 of 4 banks that offers personal loans to individuals with incomes of less than S$30,000, and could serve as a backup option for those.

ocbc personal loan malaysia Ryan Newman

OCBC Bank (Hong Kong) Limited (the "Bank") has the right to amend the above information and all applicable terms and conditions from time to time and at any time without any prior notice to or consent of any parties. The Bank reserves the right for the final judgment on credit review and approval of the loan.