4) Deposit in transit, not recorded by bank, Rp.226 Issuu

Pengertian outstanding check dan deposit in transit adalah? Pembahasan lengkapnya akan ada pada artikel Blog Mekari Jurnal. Rekonsiliasi bank merupakan proses mencocokkan saldo dalam catatan akuntansi entitas untuk akun kas dengan informasi yang sesuai pada laporan bank.

Deposit In Transit Definition Example Renconciliation

Adanya proses rekonsiliasi bank dapat terjadi karena beberapa sebab, seperti adanya setoran perusahaan ke rekening bank pada akhir bulan namun tercatat di bulan berikutnya, bisa juga karena adanya beban bank yang tidak disadari perusahaan, kesalahan pencatatan dari pihak perusahaan atau bank, cek yang masih beredar, hingga kredit oleh bank yang.

Terminology of Cash in Transit Blog SecureCash

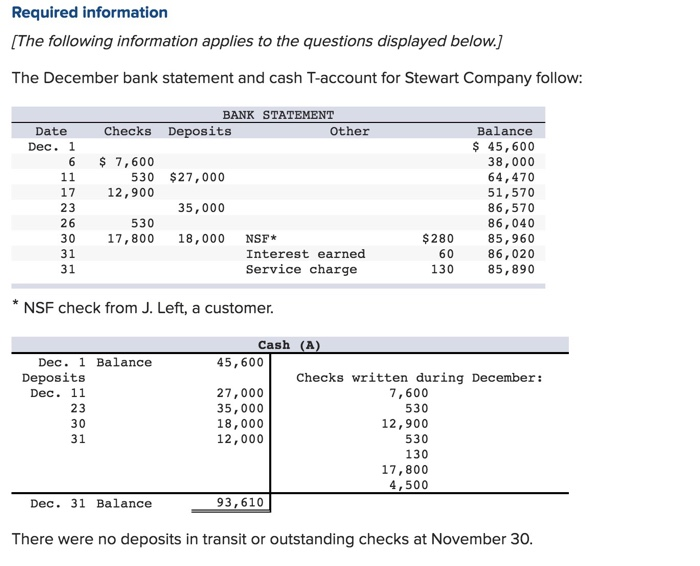

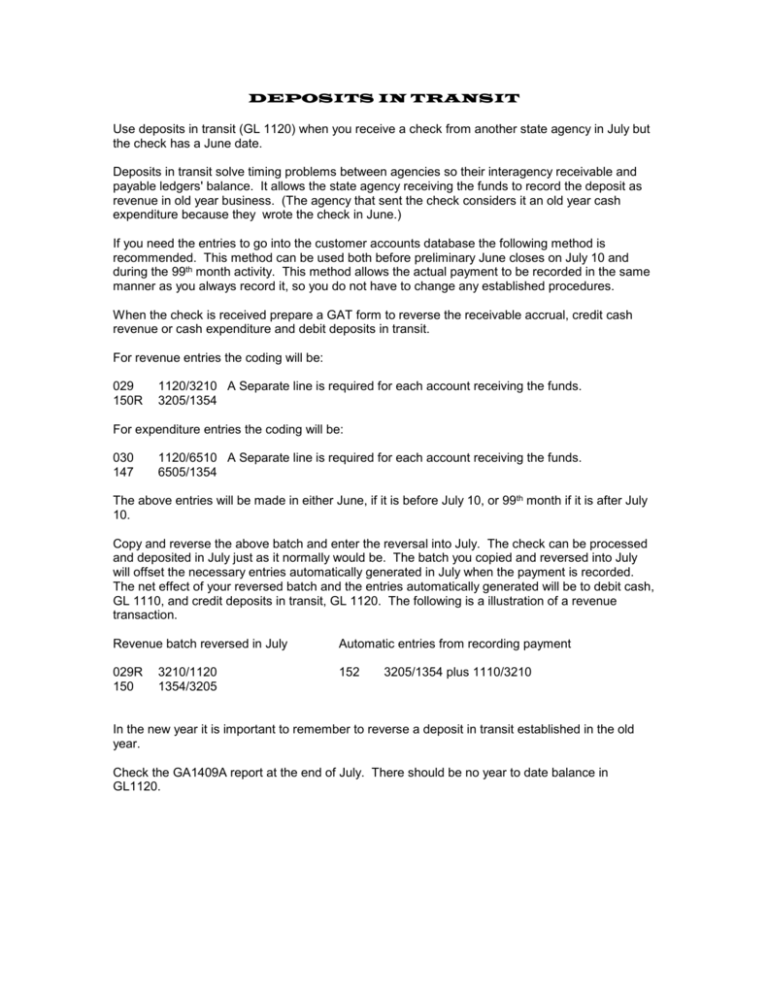

Deposits in transit are those deposits that are not reflected in the bank statement on the reconciliation date due to time lag between when a company deposits cash or cheque in its account and when the bank credits it. Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited, the balance as per bank statement would be lower.

What is a Deposit in Transit? SuperfastCPA CPA Review

Mulai Berinvestasi Sekarang! Apa Itu Rekonsiliasi Bank? Ilustrasi Rekonsiliasi Rekonsiliasi bank adalah proses pencocokan catatan antara rekening entitas dan bank. Proses ini meliputi perincian, analisis, dan verifikasi kecocokan pencatatan untuk menghindari adanya pihak yang dirugikan.

Solved 1.) Identify and list the deposits in transit at the

Apa Itu Deposit In Transit? Deposit In Transit adalah uang tunai atau cek yang tercatat dalam laporan keuangan perusahaan sebagai dana setoran entitas ke akun bank, tetapi belum dicatat dalam catatan bank tempat entitas menyetorkan dana tersebut.

:max_bytes(150000):strip_icc()/Deposit_In_Transit_Final_3-2-e91032082e4a45778c36d618b723253b.jpg)

What Is a Deposit in Transit, With an Example

A company's deposit in transit is the currency and customers' checks that have been received and are rightfully reported as cash on the date received, and the amount will not appear on the company's bank statement until a later date. A deposit in transit is also known as an outstanding deposit. When there is a deposit in transit, the amount.

Deposit Adalah Pengertian, Jenis dan Contohnya Midtrans

Example of a Deposit in Transit. As an example of a deposit in transit, ABC Corporation receives a check from a customer on April 30 in the amount of $25,000. It records the check as a cash receipt on the same day, and deposits the check at its bank at the end of the day. The bank does not record the check in its books until the following day.

Twodate Bank Reconciliation ( Computation of Deposit in transit and Outstanding Check ) YouTube

2. Recording Deposit In Transit. Once you've identified a deposit in transit, you'll need to record it in your company's accounting records. To do this, make a journal entry that credits the cash account and debits the deposit in transit account. This ensures that your financial reports paint a true picture of your business's cash.

PA53 Identifying Outstanding Checks and Deposits in Transit and preparing a Bank Reconciliation

Deposit In Transit; Deposit in transit adalah proses ketika uang tunai atau cek yang telah diterima dan dibukukan oleh perusahaan ternyata belum dicatat oleh pihak bank yang ditunjuk oleh perusahaan. Apabila kasus ini terjadi, maka uang yang ditransfer oleh pihak eksternal menuju rekening kas perusahaan tidak akan tercatat oleh pihak bank..

Two date bank reconciliation computation of deposit in transit and outstanding checks YouTube

1. Setoran dalam Proses (Deposit In Transit) Deposit in transit menjadi komponen pertama. Artinya ialah uang tunai yang telah diterima oleh pihak perusahaan, tetapi informasi penerimaan belum diperoleh bank. Ketika ini terjadi pada akhir bulan, maka tidak termasuk dalam setoran kepada bank.

Deposit in Transit Investor's wiki

Deposit in transit adalah uang tunai atau cek yang sudah diterima dan dicatat oleh perusahaan, tetapi belum dicatat dalam catatan bank tempat perusahaan tersebut menyimpan dana kasnya. Hal ini terjadi ketika data dari perusahaan terlambat sampai pada bank atau perusahaan belum mengirim laporan deposit kepada pihak bank. 2. Outstanding Check.

Lecture 04 Deposit in Transit. Outstanding Checks. Bank Reconciliation. [Intermediate

1. Deposit In Transit Komponen yang pertama adalah Deposit in Transit. Makna dari komponen ini adalah uang tunai yang sudah diterima oleh perusahaan.

DEPOSITS IN TRANSIT

The most common deposit in transit is the cash receipts deposited on the last business day of the month. Normally, deposits in transit occur only near the end of the period covered by the bank statement. For example, a deposit made in a bank's night depository on May 31 would be recorded by the company on May 31 and by the bank on June 1.

Lecture 04 Deposit in Transit. Bank Reconciliation. [Intermediate Accounting] YouTube

Deposit In Transit Komponen deposit in transit adalah uang tunai yang sudah diterima oleh perusahaan, namun informasi tersebut belum diterima oleh bank sehingga belum tercatat dalam laporan bank. Jika ini terjadi di akhir bulan, setoran tidak akan muncul pada laporan bank. Karena itu, akan menjadi item rekonsiliasi.

Deposits in Transit What are Deposits in Transit YouTube

A "deposit in transit" is an accounting term that refers to checks or other non-cash payments that a company received and recorded in its accounting system, but which have not yet been cleared by.

Pengertian Deposit, Jenis, dan Contohnya

Definition: A deposit in transit, or un-cleared deposit, is cash or check deposit that is recorded in a company's accounting system but not in the bank's records. A deposit in transit usually occurs because there is a time lapse between when the company records the deposit in their accounting software and when the deposit makes it to the bank and is recorded in the account.