Citibank Ready Credit

Issuance of Citibank Ready Credit Line facility is at the sole discretion of the bank and subject to its internal credit processing criteria. Rs. 5 Lakh is the maximum amount that can be extended under the Ready Credit facility. The final amount and interest rate applicable will be subject to eligibility as per Citibank's credit criteria.

Omise Omise enables Citibank's Ready Credit topup on TrueMoney Wallet

Citibank, popularly called Citi, is a subsidiary of Citigroup Inc. and one of the largest banks in the United States, with about 65,000 ATMs to keep your funds close. While it lacks money market.

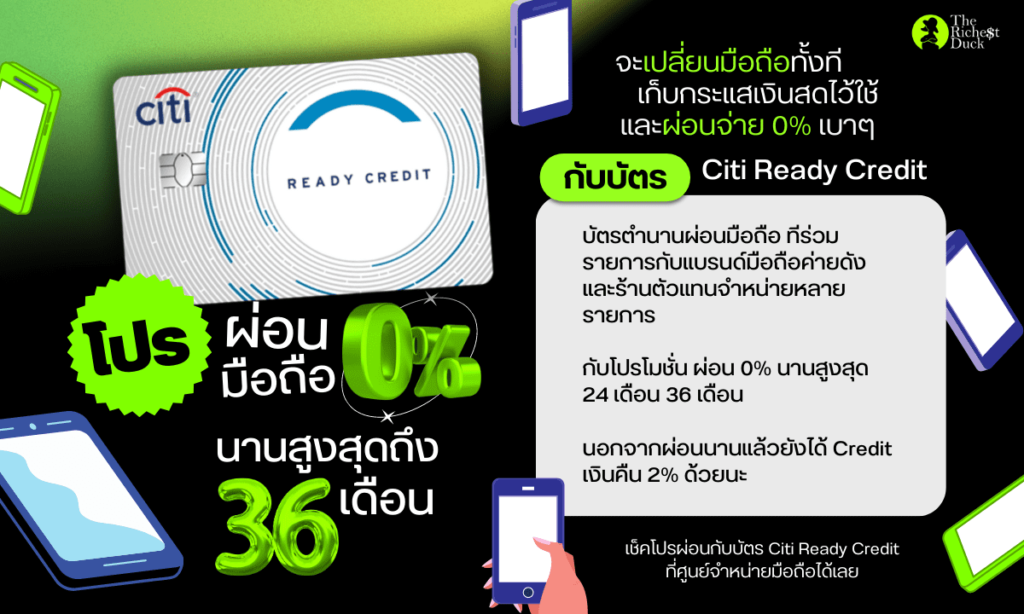

บัตร Citi Ready Credit บัตรกดเงินสดยืน 1 ที่ให้สิทธิประโยชน์คุ้มๆ มากกว่าการกดเงิน

Ready Credit account features. Ready Credit. Ready Credit features. With Ready Credit you have the freedom of enjoying what life has to offer, with cash ready when you are. Your account is a revolving line of credit, which means you can use and reuse your available credit for any purpose, at the Annual Percentage Rate, at any time 1.

Citibank Singapore

รับเงินสดทันทีภายใน 1 วันทำการและผ่อนชำระด้วย Citi Ready Credit สมัครบัตรเงินสดจากซิตี้แบงก์พร้อมรับอัตราดอกเบี้ยต่ำสุดวันนี้!

บัตร Citi Ready Credit เหมาะกับคุณไหม รู้ดี money

Citi.com is the official website of Citibank, one of the leading financial institutions in the world. Whether you are looking for credit cards, banking, mortgage, or personal loans, Citi.com has the right products and services for you. Explore the benefits of Citi cards, such as cash back, travel rewards, and low interest rates. Learn more about Citi's banking solutions, such as checking and.

Citibank Ready Credit vs HSBC Personal Line of Credit Which Credit Line is Right for You?

A Citibank Ready Credit provides you with a revolving credit line. You can withdraw the loan from the credit line anytime you wish; there is no fixed monthly repayment amount or repayment period. You can choose to repay only the minimum balance as stated on the statement or the full outstanding balance. Interest will only be charged on the.

บัตรกดเงินสด Citibank Ready Credit ให้ความสะดวกสบายเด่น ๆ อะไรบ้าง? marketsavvy.co

Daily spending limit of S$2,000 (applicable to retail Point-of-Sale transactions), for Citibank Ready Credit Cards issued on and after. 7 December 2014. You may revise the limit anytime, please visit us here. Double Swiping: The magnetic stripe on your credit or debit card contains sensitive payment card data.

How to apply Kredit Citi Ready

Open a Citi banking account online and tap into Citi's enhanced banking solutions for checking, saving, and CD accounts.

บัตรกดเงินสด Citibank Ready Credit ให้ความสะดวกสบายเด่น ๆ อะไรบ้าง? marketsavvy.co

Citi Mobile App. Get a 360° view of your finances, along with personalized spending and savings insights - at your fingertips. It's the easy way to manage your money and your accounts on the go. Or text 'APP17' to 692484 for a link to download the app.

citibank ready credit บัตรเครดิตที่มีระยะเวลาผ่อนนาน และใช้เอกสารการสมัครน้อย

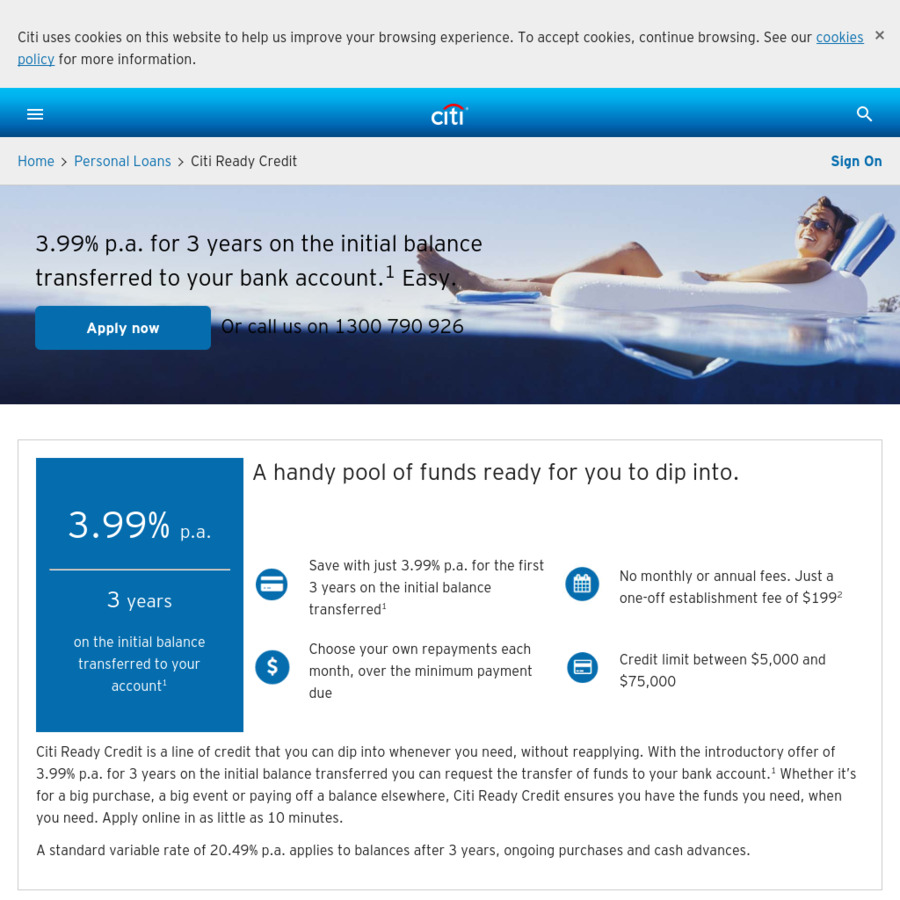

A reduced one-off establishment fee of $99, normally $1992. Citi Ready Credit is a line of credit that you can dip into whenever you need, without reapplying. Enjoy an introductory fixed rate of 8.9% p.a. for 5 years on the initial balance you request to be transferred to your bank account. 1. Apply online in as little as 10 minutes, and spend.

แนะนำ บัตรกดเงินสด citibank ready credit เงินสดสั่งได้ โอนภายใน 1 วันทำการ Thaiger ข่าวไทย

Citi Ready Credit is a line of credit that can help your travel dreams come true. Go ahead and spend on any big purchases or use it to pay off an existing balance elsewhere. Enjoy a rate of 8.9% p.a. for 5 years on the initial balance you request to be transferred to your bank account. 2. Earn 70,000 Qantas Points when you request a balance to.

Citi Ready Credit 3.99 p.a. for 3 Years on Initial Balance Transferred to Your Account, 199

1. Alliant Credit Union. The first "bank" on this list is actually a credit union. Many credit unions do not charge overdraft fees, and Alliant Credit Union is a prominent online credit union that.

citibank ready credit บัตรกดเงินสดให้เงินด่วนพร้อมใช้พร้อมสิทธิประโยชน์มากมาย ckkitchenware

Compare Credit Cards

บัตร Citi Ready Credit บัตรกดเงินสดยืน 1 ที่ให้สิทธิประโยชน์คุ้มๆ มากกว่าการกดเงิน

With Citibank Ready Credit, you have access to extra cash anytime for your emergency or liquidity needs. Flexible line of credit up to 4X your monthly income or up to 8X your monthly income if your annual income is S$120,000 and above. Subject to Bank's approval+. Attractive interest rates with flexibility to change your Citibank Ready Credit.

Citi Ready Credit Issued by UOB Pantip

Citi Ready Credit is a line of credit with a predetermined limit that gives you access to funds when you need them. Now it could be even more rewarding with 70,000 Qantas Points* available when you apply by 27 September 2023, and request a balance of $5,000 or more to be transferred to your bank account within three months of approval.

Ready Credit Citibank newstempo

Loans available in 50 states and Washington, D.C. Disclosure from Citibank. Rates as of 10‐06‐2023. Your APR may be as low as 10.49% or as high as 19.49% for the term of your loan. The lowest.