IFRS 16 Lease Accounting Software EZLease

This course gives you the basics of the product AARO Lease IFRS 16, the tool that gives you control over your leasing contracts and the IFRS 16 effects in your group. The day ends with a review of basic AARO functionality and administration, which you need to use AARO Lease IFRS 16. This review is important for those who work with the.

IFRS 16 Leases Implications and Application IFRS 16 Leases Implications and

An asset retirement obligation (ARO) is a legal obligation that is associated with the retirement of a tangible, long-term asset. It is generally applicable when a company is responsible for removing equipment or cleaning up hazardous materials at some agreed-upon future date. A company must realize the ARO for a long-term asset at the point an.

IFRS 16 Demo Lec YouTube

However IFRS allows ARO cost to be added to the carrying amount of inventories as is discussed in paragraph BC15 of IAS 16. Recognition of ARO The obligations for dismantling and restoration costs accounted for in accordance with Ind AS 2 or Ind AS 16 are recognised and measured in accordance with Ind AS 37, Provisions, Contingent Liabilities.

Brilliant Ifrs 16 Template Excel Quotation Format In Gst

Debit P/L - Finance Expenses: CU 39 (1 967*2%) Credit Provision for Decommissioning: CU 39. Now, let's say that in 20X3, your estimate of the discount rate changes to 1.8% and all the other estimates (cash flows) remain unchanged. You need to recalculate the provision and account for its changes under IFRIC 1.

IFRS 16 leases module 1 YouTube

US GAAP. Asset retirement obligations (AROs) are recorded at fair value and are based upon the legal obligation that arises as a result of the acquisition, construction, or development of a long-lived asset. The use of a credit-adjusted, risk-free rate is required for discounting purposes when an expected present-value technique is used for.

IFRS 16 Lease Accounting Software EZLease

IFRS 16 is effective for annual periods beginning on or after 1 January 2019. Early application is permitted, provided the new revenue standard, IFRS 15 Revenue from Contracts with Customers, has been applied, or is applied at the same date as IFRS 16. IFRS 16 requires lessees to recognise most leases on their balance sheets.

IFRS 16 How to get compliant? Planon

In-depth application guidance on the new leasing standard. We have been releasing our in-depth application guidance on IFRS 16 Leases in manageable chunks, one chapter at a time. Each one focuses on a particular aspect and includes explanations of the requirements and examples showing them in practice, to help you apply the new standard.

IFRS IN PRACTICE IFRS 16 Leases

Asset retirement obligation under ASC 842, IFRS 16 and GASB 87. By Visual Lease January 30, 2020 Lease Accounting, Lease Administration, Lease Management. If you have signed an operating lease for space, built leasehold improvements, and determined that you are legally required to take out the leasehold improvement when the lease expires, then.

Editora Roncarati Entendimento sobre o IFRS 16 Operações de arrendamento mercantil Artigos

14.1.8 Presentation and disclosure (ASC 842 and IFRS 16) For lessees, the presentation of the right-of-use assets and lease liabilities are similar under the standards. Amounts relating to leases are presented separate from other assets and liabilities on the balance sheet or in the notes to the financial statements.

IFRS 16 (CPC 06) Arrendamento Mercantil Premium Bravo Auditoria Independente e Consultoria

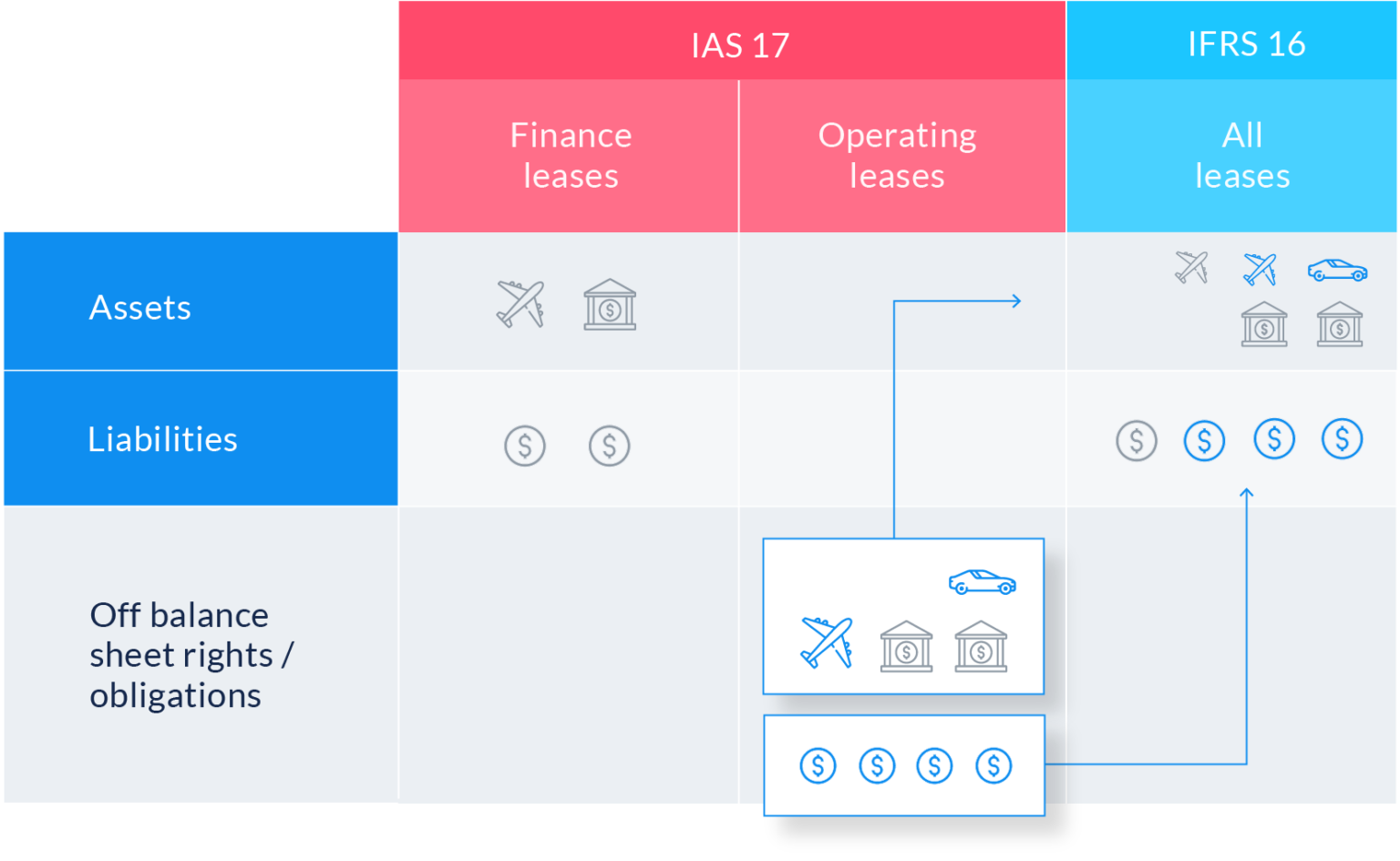

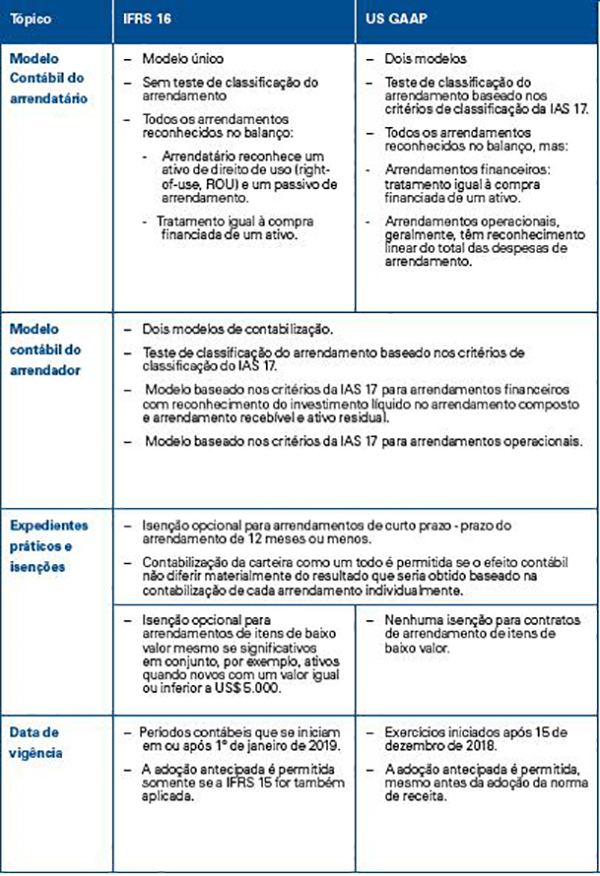

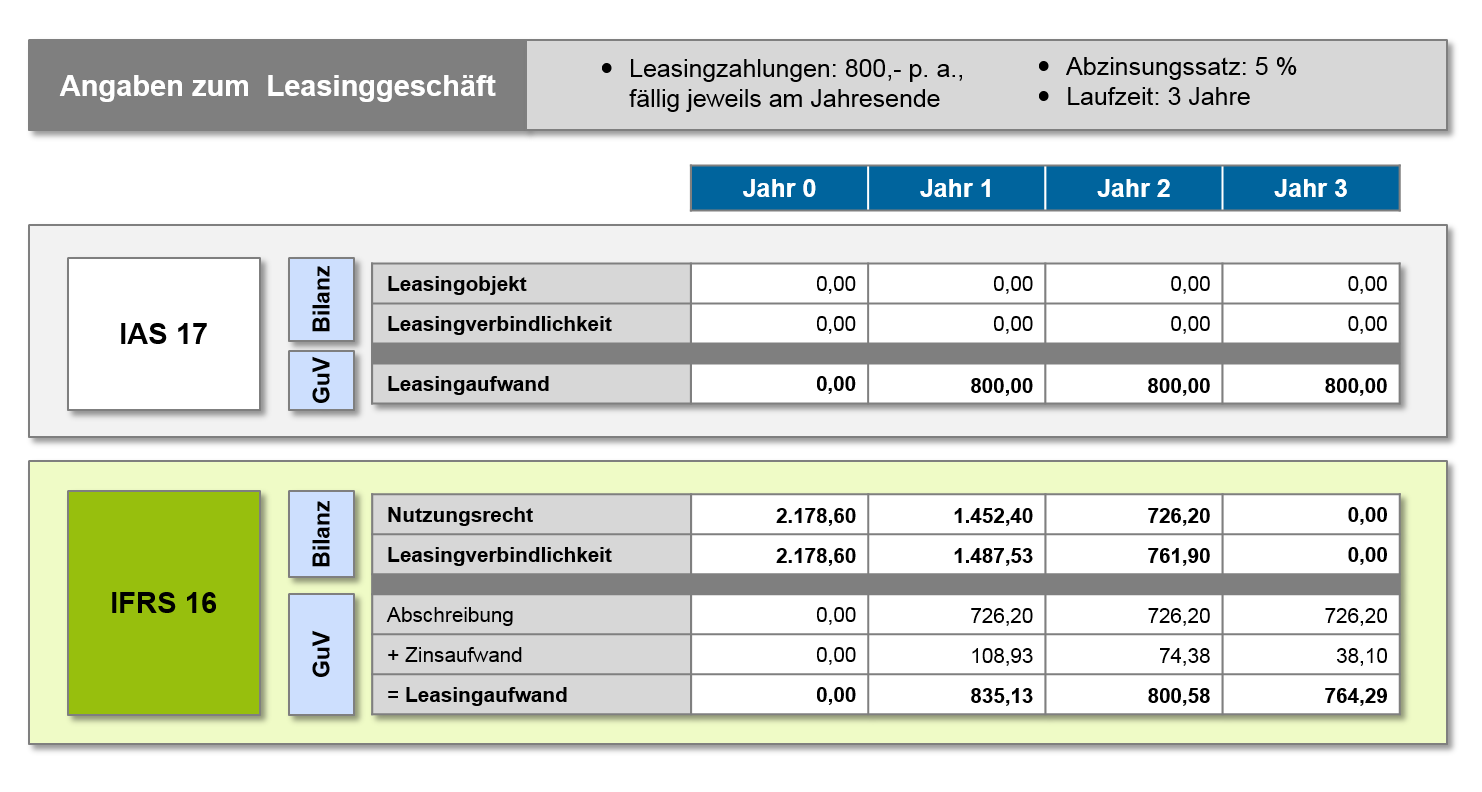

Some of these Day Two accounting differences are driven by the use of a single on-balance sheet lease accounting model under IFRS Standards as compared with a dual classification on-balance sheet lease accounting model under US GAAP (i.e. finance leases and operating leases). IFRS 16 effectively treats all on-balance sheet leases as finance.

IFRS 16 Leases raubt den OffBalanceVorteil für Leasingnehmer BankingHub

The application of IFRS 16.C10(c) is tantamount to treating the leases as short-term leases from the DIA. Accordingly, Entity B applies the guidance in IFRS 16.5-8 to such leases. In accordance with IFRS 16.7(a), when a short-term lease is modified, the lease is considered to be a new lease on the effective date of the modification.

Ifrs 16 Leases A Simplified Summary Of Ifrs 16 With Practical Hot Sex Picture

The different treatment arises at the level of depreciation for operational leases under US GAAP, whereby the lease expense will be presented as a straight-line expense over the lease term. Another important difference is the effective date: whereas IFRS 16 became effective as of 1January 2019 and ASC842 is effective for annual periods.

IFRS 16 O que é e o que mudou para o Arrendamento Mercantil?

In January 2016 the Board issued IFRS 16 Leases. IFRS 16 replaces IAS 17, IFRIC 4, SIC-15 and SIC-27. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases. In May 2020 the Board issued Covid-19-Related Rent Concessions, which amended IFRS 16.

Leases IFRS 16

The module is aimed for accounting professionals, managers and financial controllers who require knowledge or refresher on IFRS 16 and whose lease accounting knowledge is theoretical, newly employed staff, or fresh graduates taking up new accounting roles. You don't have to be an AARO user to participate, the training suits everyone working.

IFRS 16 video 10a Eng YouTube

1 IFRS 16 at a glance 1.1 Key facts This publication provides an overview of IFRS 16 and how it affects the financial statements of the lessee and the lessor. It includes examples and insights. The publication begins with an overview of the lessee and lessor accounting models, summarising the impact of IFRS 16 on their respective financial

TECH6 WEBINAR IFRS 16 Entenda o impacto da norma nas Operadoras de Plano de Saúde

3.4 Recognition and measurement (AROs) Asset retirement obligations are initially recognized as a liability at fair value, with a corresponding asset retirement cost (ARC) recognized as part of the related long-lived asset. Figure PPE 3-1 highlights accounting considerations over the life of an ARO; each phase is discussed in more detail in the.