Accrued expenses — AccountingTools India Dictionary

In this case, VIRON Company already incurred (consumed/used) the expense. Even if it has not yet been paid, it should be recorded as an expense. The necessary adjusting entry would be: Example 2: VIRON Company borrowed $6,000 at 12% interest on August 1, 2021. The amount will be paid after 1 year.

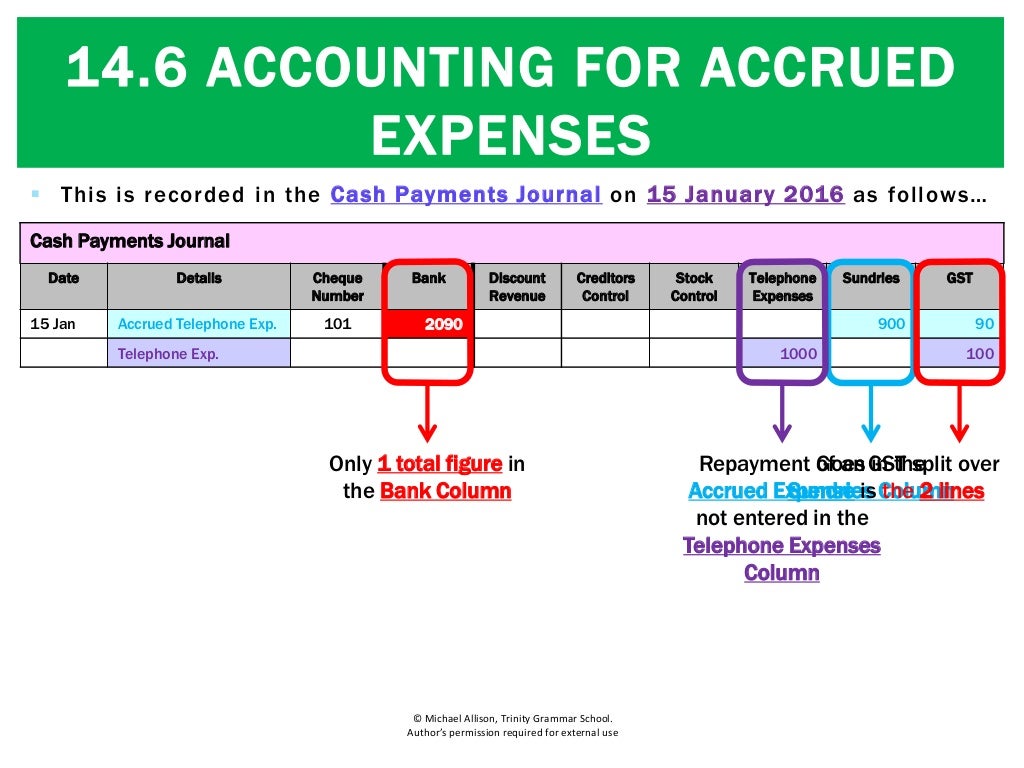

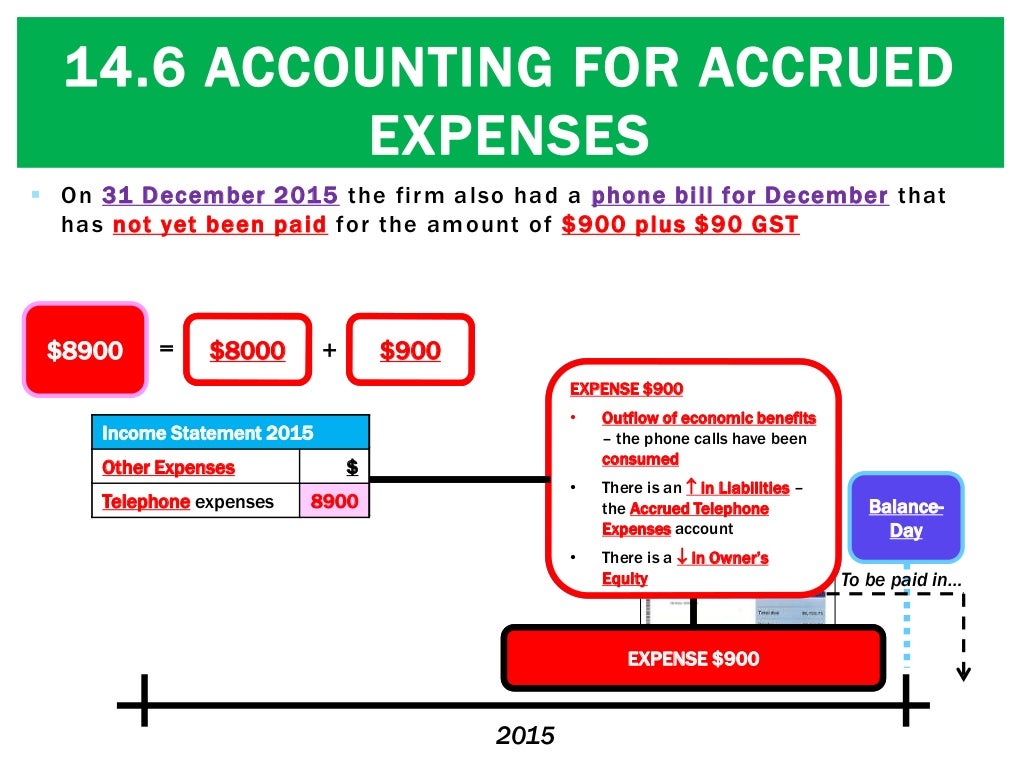

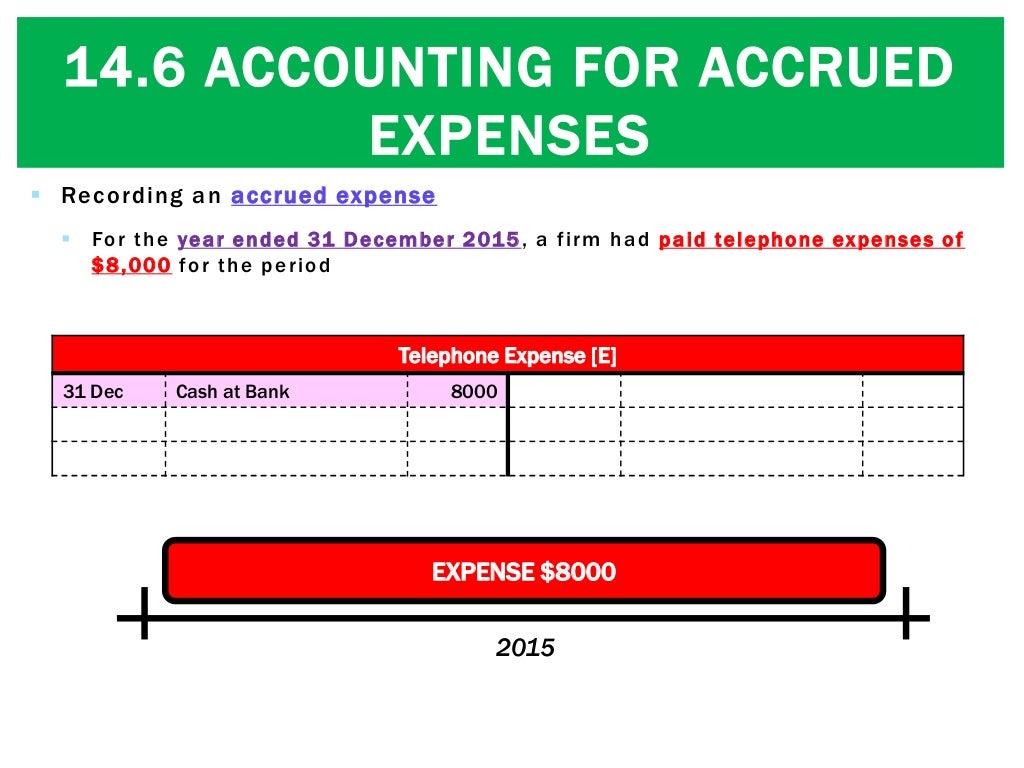

14.6 Accounting for Accrued Expenses

Accrued Expenses, often referred to simply as "Accruals," are financial obligations that a company has incurred but hasn't paid for yet. These obligations encompass various costs, such as.

Unit 3 VCE Accounting Accrued Expenses YouTube

Accrued revenues merupakan kata lain dari pendapatan yang harus dibayar atau piutang pendapatan. Artinya ada transaksi pendapatan yang telah dilakukan, tetapi uangnya belum diterima atau baru didapat pada periode yang telah dijanjikan. Dalam ekonomi, accrued revenues mudah ditemui di perusahaan jasa. Karena pendapatan akan diterima setelah.

All You Need To Know About Accrued Expenses

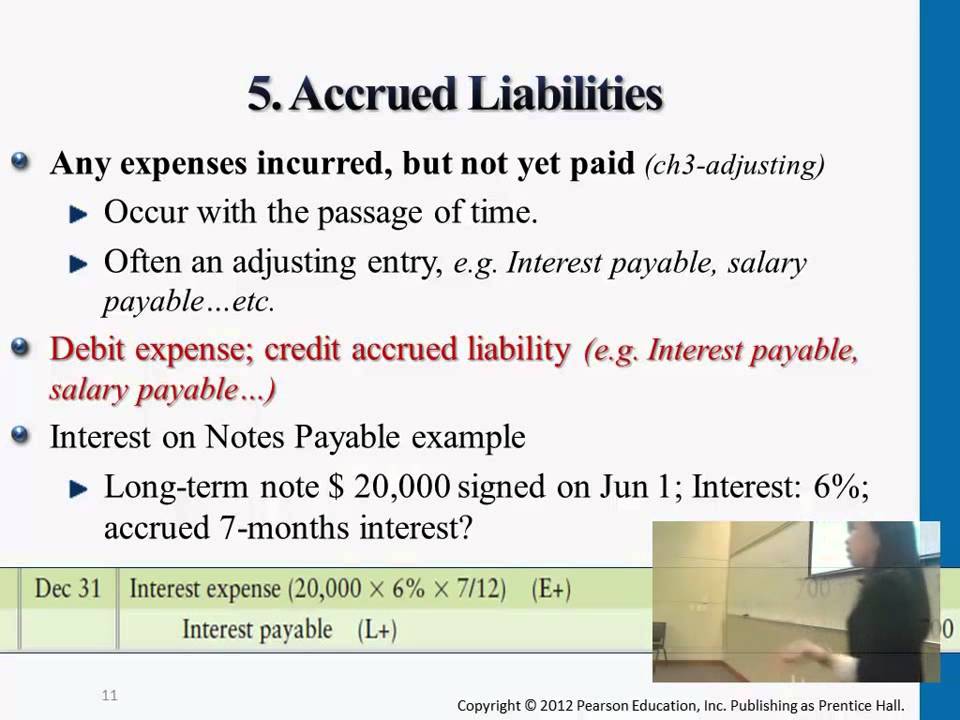

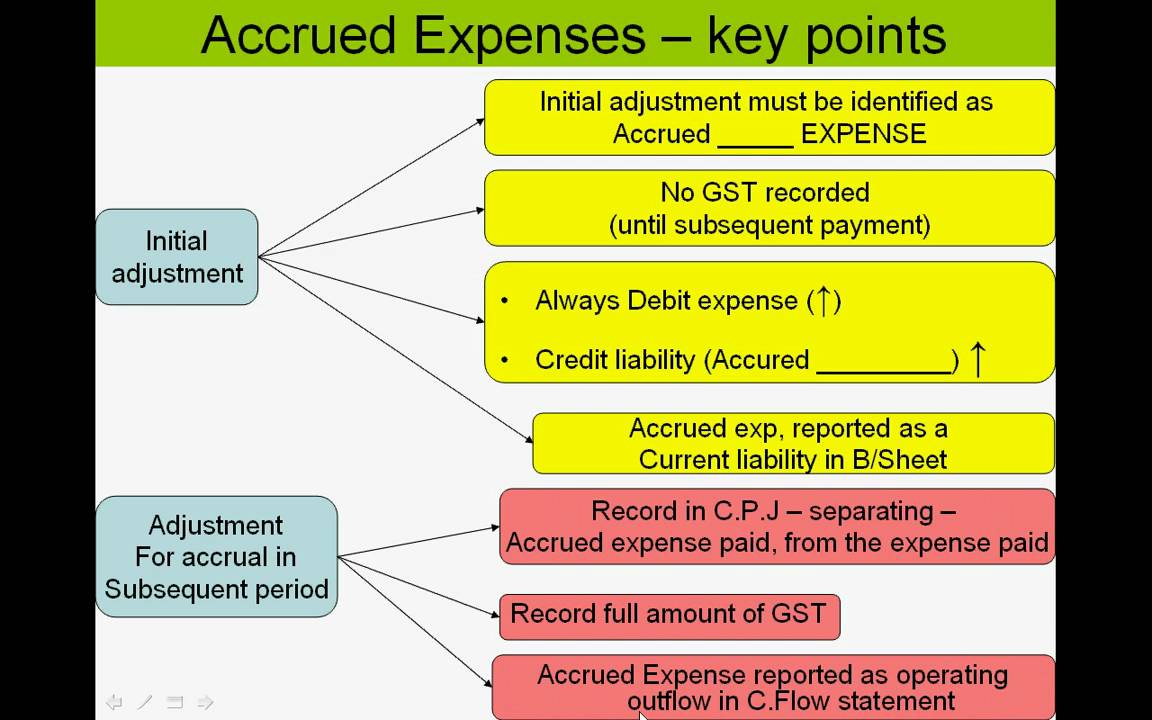

Accrued expenses are expenses that your company has taken on but has not yet paid. Accrued expenses are also called accrued liabilities because they become a debt you owe, based on receiving a product, service, or operational expense. The accrual method of accounting is often contrasted with cash-basis accounting.

14.6 Accounting for Accrued Expenses

Accrue is a term used to describe the ability for something to accumulate over time, and is most commonly used when referring to the interest , income or expenses of an individual or business.

Accrued expenses journal entry and examples Financial

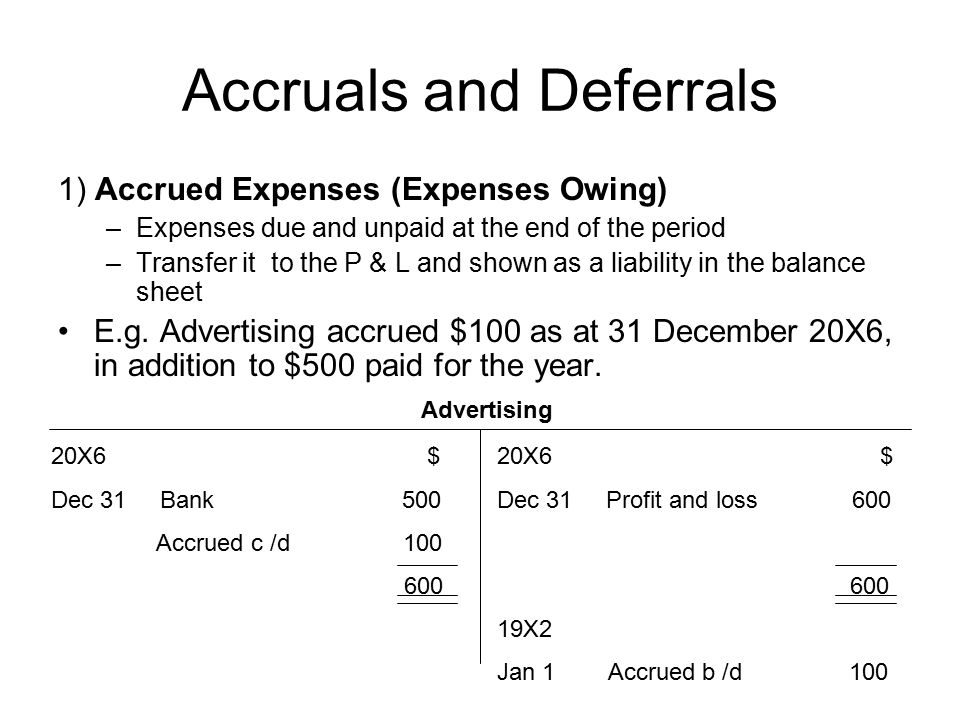

An accrued expense is an expense that has been incurred, but for which there is not yet any expenditure documentation. In place of the documentation, a journal entry is created to record an accrued expense, as well as an offsetting liability. In the absence of a journal entry, the expense would not appear at all in the entity's financial.

PPT Journal Entries PowerPoint Presentation, free download ID5068310

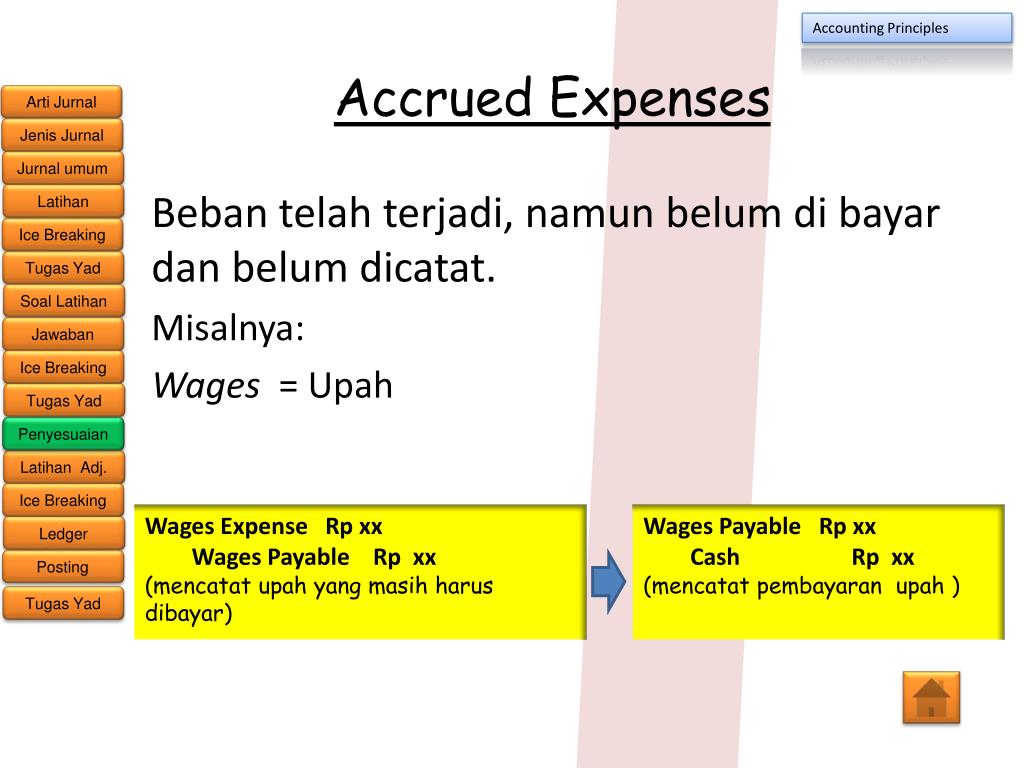

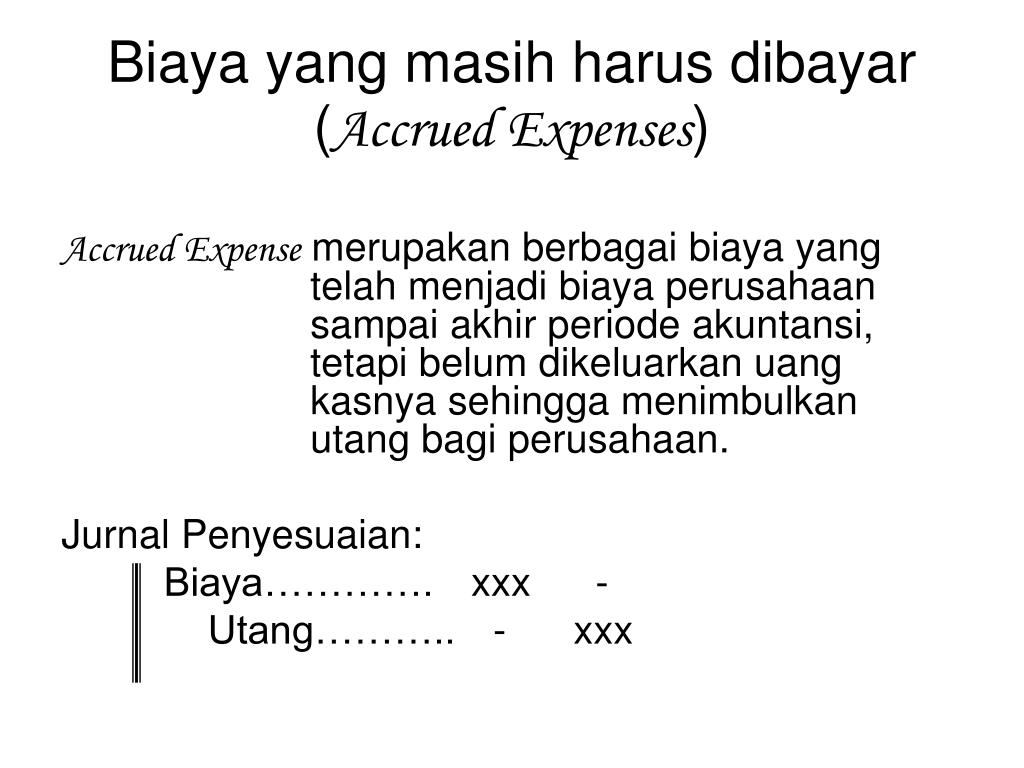

1. Pengertian. Accrued expense adalah kewajiban perusahaan untuk membayar biaya tertentu di masa mendatang, dan sudah diakui dalam laporan keuangan. Sementara itu, account payable adalah utang yang timbul akibat pembelian barang atau jasa dari pihak ketiga, dan harus dibayarkan dalam tenggat waktu tertentu. 2.

Pengertian Accrued Expenses dan Accrued Revenues dalam Bisnis • Keysoft ERP

Contoh Apa Saja yang Termasuk Accrued Expense. Agar memiliki gambaran mengenai accrued expense, berikut ini beberapa contohnya yang tercatat sebagai beban dalam laporan keuangan.. 1. Gaji/Upah. Gaji ataupun upah adalah beban dalam laporan keuangan yang tergolong sebagai accrued expense jika karyawan belum menerima gaji atau upah yang mesti dibayar perusahaan.

What are Accrued Expenses? Accounting Journal Entries

Accrued expense adalah istilah akuntansi yang merujuk pada biaya yang telah terjadi namun belum dibayar pada saat laporan keuangan dibuat. Dalam bahasa Indonesia bisa diartikan sebagai "Beban yang belum dibayar". Meskipun belum terbayar, biaya-biaya tersebut harus dicatat sebagai kewajiban dan dimasukkan ke dalam laporan keuangan.

Contoh Jurnal Accrued Expense / Pengertian Jurnal Penyesuaian Beserta Cara Pencatatannya

Accrued expenses, also known as accrued liabilities, are costs that a company has incurred but has not yet paid. These expenses can be found on a company's balance sheet and are recorded using the accrual method of accounting. Examining accrued expenses allows management to gain valuable insight into the company's financial standing.

What are Accrued Expenses? Definition + Examples

Accrued Expenses = $12m — Decline by 0.5% as Percentage of OpEx Each Year. In Year 0, our historical period, we can calculate the driver as: Accrued Expenses % of OpEx (Year 0) = $12m / $80m = 15.0%. Then, for the forecast period, the accrued expenses will be equal to the % OpEx assumption multiplied by the matching period OpEx.

Accrued Expense Examples of Accrued Expenses

How to record an accrued expense. Determining whether an accrued expense is debit vs. credit all has to do with when it is recorded. Whenever you first accrue the expense it is recorded as a credit, and once you pay the expense it then gets recorded as a debit. Instance #1 (debit): Whenever you accrue an expense you will record it as credit.

The accrual basis of accounting Business Accounting

You may have accrued expenses from various sources. A few examples of the accrued expenses that your company might need to track include: Loan interest. Wage expenses. Payments owed to contractors and vendors. Government taxes. Property rental costs. Utility expenses. Rent expense.

14.6 Accounting for Accrued Expenses

Cost Accounting (Akuntansi Biaya) adalah: Pengertian, Jenis, dan 5 Fungsinya. Akuntansi kas dan akuntansi akrual (sumber: pexels) Business Plan: Tujuan dan 6 Panduan Lengkapnya. Account payable dan accrued expense berbeda meski nampak sama. (sumber: pexels) nampak serupa dan sama-sama dicatat di bawah kewajiban neraca perusahan, ternyata.

Mengenal Apa Itu Accrued Expense dan Jenisnya

Expense: when a company has received services and goods but it hasn't made a payment yet. An example is a company receiving an electricity bill in March for the last few months' electricity usage. The business would record this as an expense accrual. Revenue: when a company has provided goods or services but payment hasn't yet been.

Accruals and Deferrals Double Entry Bookkeeping

Umumnya, accrued expense adalah beban perusahaan yang sudah tercatat dalam catatan keuangan sebelum perusahaan melakukan pembayaran. Contoh accrued expense ini akan Anda temui selama periode akuntansi dikeluarkan oleh organisasi. Accrued adalah kewajiban lancar bagi perusahaan yang akan ditampilkan pada neraca bisnis beserta biaya marginal dan.